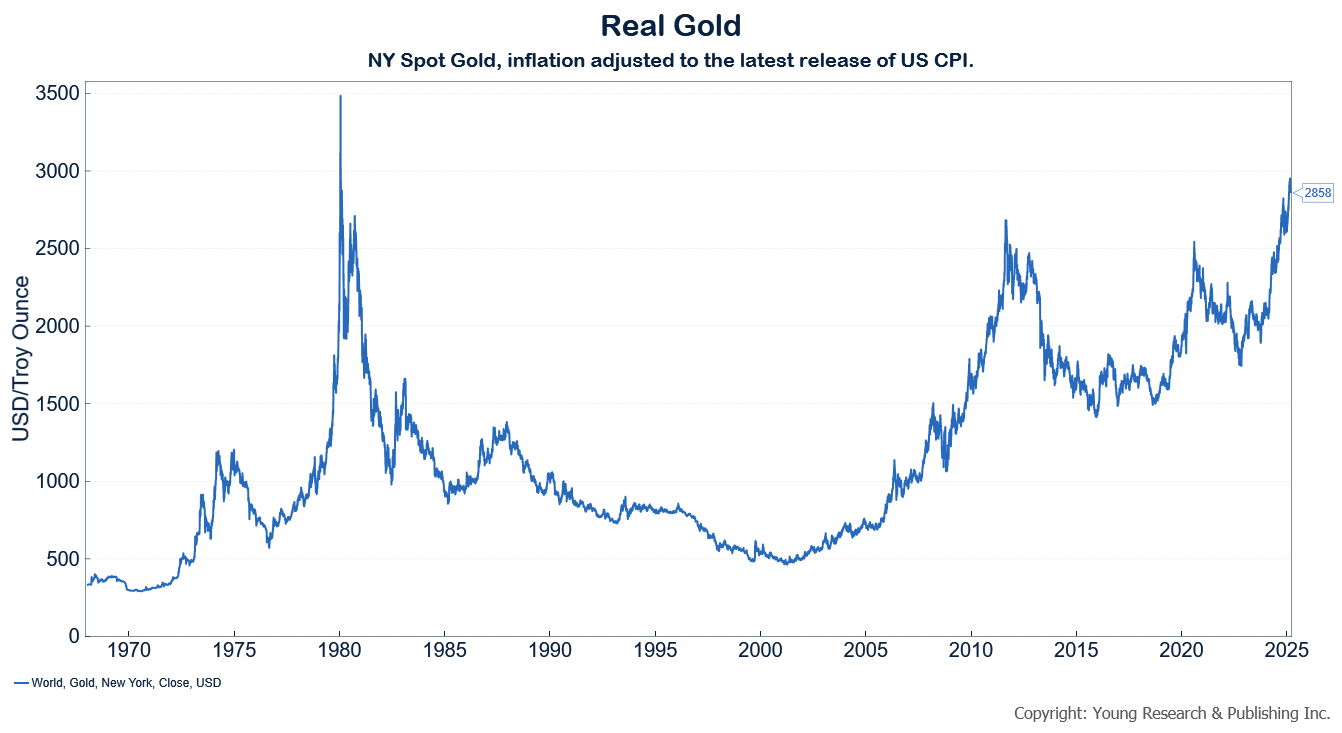

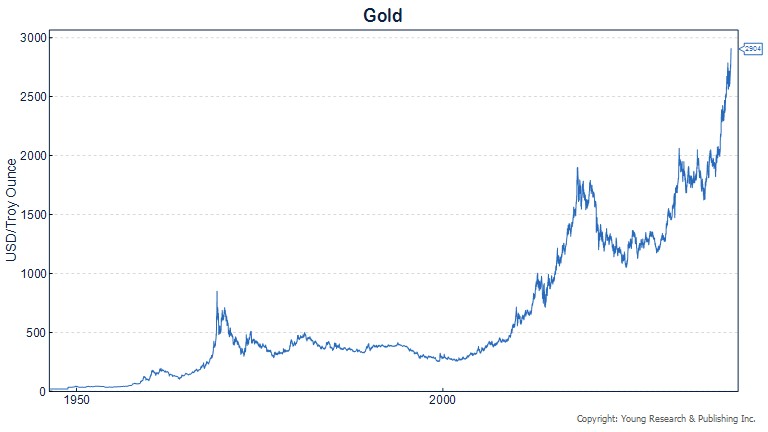

As the purchasing power of the American dollar has declined steadily since gold convertibility ended in 1971, the purchasing power of an ounce of gold is strong. The spot price of gold closed at an all-time high of $2,989 yesterday and crossed over $3,000 an ounce in trading today.

The purchasing power of gold is also near record highs, though it hasn’t quite exceeded its peak during the hyperinflation of the 1980s.

Since 1913, the year the Federal Reserve was created, the purchasing power of the U.S. dollar has fallen by 96%. The purchasing power of a single ounce of gold over that same time period has more than doubled. That is no coincidence. Gold is a store of value—a wealth preservation vehicle. Gold won’t make you rich, but it also won’t make you poor. Gold is a currency. It can’t go bankrupt or lose its value because of poor management, accounting fraud, world war, or hyperinflation. Investors who truly understand gold recognize that gold should be counted in ounces, not in dollars. Because while the dollar value of gold may fluctuate from year to year, it will be worth many times its current value during the next generation and in those that follow.

Markets are stormy. Find your port in the storm by clicking here to subscribe to the Young’s World Money Forecast email alert.