Happy Easter from Dick and Debbie in the Florida Keys.

Javier Milei: A Light in Argentina’s Darkness?

Panorama of the city of Buenos Aires, Argentina, near the National Congress Palace. By Dudarev Mikhail @ Shutterstock.com

Argentina has suffered rampant inflation, bad government, and declining freedom for years. Now, according to Daniel Raisbeck at the Cato Institute, Argentinians have the opportunity to elect someone with a real plan to give them back control. Raisbeck writes:

“We are all Peronists,” remarked Argentina’s corporatist strongman Juan Domingo Perón in 1972, the year before he assumed the presidency for the second time. His quip turned out to be more accurate for the 21st century than for his own times; in 1976, Perón’s second wife, Isabel, was ousted from power by a military junta that ruled until 1983, when the Peronist Justicialist Party lost the presidential election in an upset. Since 2003, however, Argentina has been under left‐wing, Peronist governments for all but four years.

In the 2015 presidential election, Mauricio Macri, a center‐right businessman, narrowly defeated his Peronist opponent with the promise to cut inflation to a single digit and allow a stagnant economy to grow. During Macri’s four‐year term, however, inflation doubled (from 27 to 54 percent), the country’s Gross Domestic Product shrank, and the Argentine peso plummeted against the dollar. Having failed to cut public spending, Macri turned to the International Monetary Fund for the largest loan in the institution’s history ($57 billion). In late 2019, Macri lost his reelection bid to the current, Justicialist Party president Alberto Fernández, a Peronist ally of former leader Cristina Fernández de Kirchner. The latter was in office between 2007 and 2015, having succeeded her deceased husband, Nestor Kirchner, the winner of the 2003 election.

In theory, this year’s election should have been a rematch of the 2019 campaign. However, neither Fernandez nor Macri will be on the ballot. The former, who has presided over a debt default in 2020 and what is now triple‐digit inflation—the official, annual rate was 114 percent in June—decided (no doubt wisely) not to run. Macri, who would have faced serious primary contenders in his own party, stepped aside as well. Still, the pundits were expecting their respective successors to face off for the presidency. Voters had other things in mind.

The Peronists are grouped under a coalition called “Frente de Todos” (Everyone’s Front). The main center‐right opposition, led by Macri until recently, is called “Juntos por el Cambio” (United for Change). Contrary to polling forecasts, neither side obtained the largest percentage of the vote in Sunday’s mandatory presidential primaries. Instead, the overall winner—with 30 percent of the vote— was Javier Milei, a free‐market economist who was first elected as a Congressman for a newly created party—Liberty Advances— in November of 2021.

Milei came to prominence as an outspoken guest in political television shows, where he lambasted Cristina Kirchner, the current vice‐president, for economic incompetence and her government’s blatant corruption (last December, an Argentine federal court found Kirchner guilty of appropriating close to USD $1 billion from sham contracts and spurious infrastructure projects). Macri, Kirchner’s successor, fared little better according to Milei, who remarked that the former president’s government merely offered “socialism with good manners.”

A former heavy metal vocalist, Milei has proven to be a skilled showman, with a particular talent for illustrating that, when applied, the theories of classical liberalism benefit the ordinary man. From the outset of his congressional term, Milei announced that he would not accept his due salary. Instead, he carries out a monthly raffle in which anyone can register for a chance to win around nine times the national monthly minimum wage. Whereas his opponents decry a dangerous, self‐promoting scheme to gather personal data from thousands of participants, Milei explains that he is returning to the taxpayers what is rightfully theirs.

Milei’s idiosyncracies—he thanked his four dogs for helping him to victory— his disheveled, polemical style, and his routinely packed political rallies, which resemble hard rock concerts, all might seem to preclude any ideological coherence. That is not the case. Milei’s platform affirms that “the Argentine state is the principal cause of Argentines’ poverty.” It includes a unilateral commercial opening for highly protectionist Argentina, the privatization of all state‐owned companies, a universal school voucher program, a 15 percent reduction in public spending as a percentage of GDP, eliminating 17 of 25 ministries or departments of state, and getting rid of utilities, subsidies, and price controls.

Milei’s main mentor is Alberto Benegas Lynch, a respected classical liberal economist. He considers Milei an heir to Juan Bautista Alberdi, the creator of the 1853 constitution, and credits him with having “transferred (classical) liberal ideas to the political sphere after an absence of eight decades.” Benegas Lynch’s father, Alberto Benegas Sr., founded a think tank in the 1950s, the Center for Liberty Studies, which invited Austrian economist Ludwig von Mises—among other scholars— to lecture in Buenos Aires. Milei is thus the product of a rich intellectual pedigree.

Milei’s critics still denounce him as a demagogue with an arsenal of questionable antics, beginning with his trademark profanity, which he routinely aims at particular opponents and the “political caste” in general. Ideologically, left‐wingers tend to attack Milei for his radical “neoliberal” agenda. The intelligentsia also has tried to associate Milei with nationalist and “populist” right‐wing figures such as Donald Trump and Jair Bolsonaro. The press regularly describes him as “ultra right‐wing.”

The problem with that theory is that, although Milei seems not to mind the Trump‐Bolsonaro associations and even encourages them, he is certainly no economic nationalist. In fact, his trademark policy proposal to tame inflation in Argentina is to dollarize the economy, shut down the central bank, and get rid of the national currency. As my colleague Gabriela Calderón and I argue in a recent Cato Institute policy brief, dollarization is both necessary and long overdue in Argentina. In the primaries, the largest block of voters agreed.

The charges of demagoguery against Milei ring most true in terms of certain policy proposals that seem unachievable. For instance, his platform aims to cut public spending drastically without firing any current functionaries and to eliminate subsidies and price controls without affecting artificially low utility bills. As economist Iván Carrino notes, solving such problems painlessly is highly improbable.

A few days ago, Milei was still an underdog, struggling for relevance in a three‐way race according to the polls. Now he is the man to beat for both of his main opponents: Patricia Bullrich, Macri’s former Minister of Security, and Sergio Massa, the Peronist candidate and current Minister of Finance. Were he to win the presidency in October, Milei is unlikely to implement all of his ambitious agenda. If he manages to dollarize Argentina, however, Milei will have deprived the political class of any ability to carry out monetary policy, thus breaking the long cycle of currency devaluation, monetized debt, triple‐digit inflation, and chronically decreasing purchasing power. This alone would be a monumental service to his countrymen.

As things stand, Massa would be eliminated in the first round of voting in October, with Milei and Bullrich proceeding to a run‐off in November. In which case one thing will be certain: Argentines are all Peronists no longer.

Read more here.

Happy Memorial Day!

The Final Richard C. Young’s Intelligence Report

After meeting monthly strategy report deadlines since 1978, I have decided it’s time to switch gears.

The name Intelligence Report will survive, but with no contribution from Richard C. Young.

Instead, I am transitioning aggressively to full-time research on behalf of private clients of our family investment management firm, Richard C. Young & Co. Ltd.

In this expanded venture, I will completely shift away from common stock mutual funds. I will concentrate laser like on “Dividends Around the World” from domestic and foreign common stocks with track records of increasing dividends for at least the last decade.

The Return of Young’s World Money Forecast

Supporting my international intelligence gathering and research efforts will be the return, after nearly a four-decade hiatus, of Young’s World Money Forecast (YWMF). I will be using YWMF techniques, gathered on Wall Street in the late sixties and early seventies, to provide breaking trends years ahead of the crowd. Here I am looking at a mix of inference reading and anecdotal evidence gathering based on my annual over 15,000 domestic miles on the road as well as at least two research forays to Europe each year.

Although I will not be making my portfolio management and specific dividend stock advice available at youngsworldmoneyforecast.com, I will be presenting regularly updated and customized information on all the dividend-paying stocks I’ve advised on over the years as well as input on every stock in the DOW 30. (Check back here regularly for date of site opening.)

Although I will not be making my portfolio management and specific dividend stock advice available at youngsworldmoneyforecast.com, I will be presenting regularly updated and customized information on all the dividend-paying stocks I’ve advised on over the years as well as input on every stock in the DOW 30. (Check back here regularly for date of site opening.)

A veritable treasure trove of intelligence will be at your fingertips daily—thanks to our unique $30,000/year database. You’ll feel as if you have arrived at a private investment club after all the years you have spent with me and the “monthly printed word.” Among the plethora of improvements you will experience with YWMF online is an enormous timing advantage. You’ll be able to access ongoing regular and actionable dividend stock updates from me in real time, rather than wait for the archaic snail mail. That’s one of the forward looking conclusions I came to when deciding to shut down my monthly deadline and dated in-the-mail effort.

My concentration will continue, as it has been over the decades, on strictly dividend-paying, dividend-increasing stocks. I, however, am making a clean break from the common stock mutual fund universe that I have been deeply involved with since the early sixties. Many of my long-time favorites have become too big for their own good or for that matter anyone else’s. Many funds have failed to keep up on many fronts, including expenses. I abhor the stupidity and self-serving interest of multiple portfolio managers. This dreadful and obfuscating transition has everything to do with dinosaur status and size limitations rather than you the investor. I will continue researching fixed-income and balanced portfolios, where I continue to find great value in individual manager input.

Ben Graham (the all-time dividend maven) was fond of stating: “One of the most persuasive tests of high quality is an uninterrupted record of dividend payments for the last 20 years or more. Indeed the defensive investor might be justified in limiting his purchases to those (stocks) meeting this test.”

The Road Ahead in Real-Time

Well there you have it—my transformation from delayed and printed monthly copy to a rapid-fire, digital presentation (not in audio or books, of course) is now in the exciting kickoff phase.

As my online dividend intelligence program develops steam, I will be able to refine and improve upon my efforts since I am no longer constrained by a once-per-month communication. What was especially frustrating was the obvious, but perhaps not fully recognized, 10-day delay from the time I finished writing Intelligence Report to the time you, as a subscriber, received my finished report.

Today and in the future, any time I have a breaking idea, it will be available for your use immediately at YWMF. That has to have a pretty good sound to you. It sure does to me.

Thank you for your years of loyalty. I have worked diligently for over five decades on behalf of private client investors just like you. It is exciting that we can all transition together to a whole new and powerful world of compounding, (more here on compounding) profiting and sleeping soundly investing in the high-octane power of long term “Dividends Around the World.”

Warm regards,

Richard C. Young

P.S. I wrote in the May 2015 issue of Intelligence Report about Ronald Read, who despite working as a janitor was able to use the power of compounding to amass an $8 million fortune by the time he passed at the age of 92.

Pumping Gas to the Tune of $8 Million

Hard to even comprehend, but this great story, courtesy the WSJ’s Anna Prior, recounts how Ronald Read accumulated an estate valued at almost $8 million. Mr. Read, who passed away at the age of 92, made a modest living pumping gas for many years at a Gulf gas station in Brattleboro, Vermont.

A Five-Inch Stack of Stock Certificates

How did Ronald Read manage to become a multi-millionaire? Mr. Read invested in dividend-paying blue-chip stocks. As Ms. Prior writes, Mr. Read took delivery of the actual stock certificates and “left behind a five-inch-thick stack of stock certificates in a safe-deposit box.” At his passing, Mr. Read owned over 90 stocks and had held his positions often for decades. The companies he owned paid longtime dividends. And when his dividend checks came in the mail, Ronald Read reinvested in additional shares. Apparently Mr. Read was the master of the theory of compound interest. Not surprising, his list of stock holdings included such dividend payers as Johnson & Johnson (NYSE: JNJ), Procter & Gamble (NYSE:PG), J.M. Smucker (NYSE: SJM), and CVS Health (NYSE: CVS), all names I write about for you here. No high flyers for Ronald Read, and certainly no technology names.

Protect, Preserve, Patience, Perspective

Obviously Ronald Read had been a staunch practitioner of my PPPP theme, featuring the basics—Protect, Preserve, Patience, Perspective. This WSJ feature article hit the press at the perfect time for me and you, as I’ll now explain. For the first time since I created my Monster Master List—well over a decade ago—I have given the Master List of common stock names a complete overhaul. I have spent weeks in the process with the goal of giving you not only a roster of dividend payers but also a list where every core company has increased its dividend for a minimum of 10 consecutive years. I have rounded out the core list with a handful of special situation dividend payers.

Originally posted on August 14, 2017.

Richard C. Young & Co., Ltd named to Barron’s Top 100 Independent Advisors for Seventh Consecutive Year

I am pleased to announce that for the seventh consecutive year our boutique conservative investment counsel firm has been named in Barron’s Top Independent Advisors list (2012-2018). Disclosure Our firm’s inclusion is notable because the nature of the investment advisory business is changing and not for the better. Private equity firms, breakaway brokers, and others more focused on gathering client assets than providing high value investment counsel are now a dominant force in the advisory business.

The Barron’s list is unfortunately becoming institutionalized. There is now a separate firm list for the likes of Edelman Financial, Creative Planning (dropped this year for potential regulatory infractions), and United Capital Financial Advisers.

With tens of thousands of clients and hundreds of advisors, there is nothing boutique about these firms. Acquisitions and asset gathering are the order of the day. These firms are becoming mini-versions of Vanguard or Schwab call centers, but with store fronts. Few do proper investment research and analysis. And the fees of some are far from client friendly. Charging 1.50% out of the gates for an index-based ETF portfolio and some basic financial planning as some “advisors” do may be worse than the 2 and 20 model of hedge funds. At least the hedge funds are working for the fees their clients are paying.

Richard C. Young & Co., Ltd. has always been a boutique investment counsel firm and it will remain that way whether that means staying on the Barron’s list or getting knocked off by this new breed of acquisition hungry advisors. Our clients financial well-being has always been our number one priority and it will always remain that way.

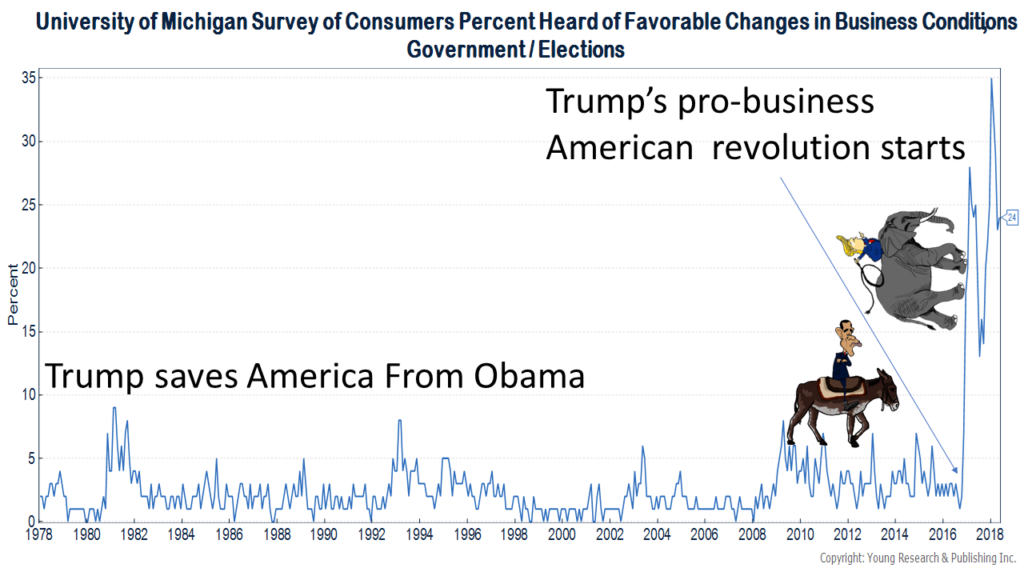

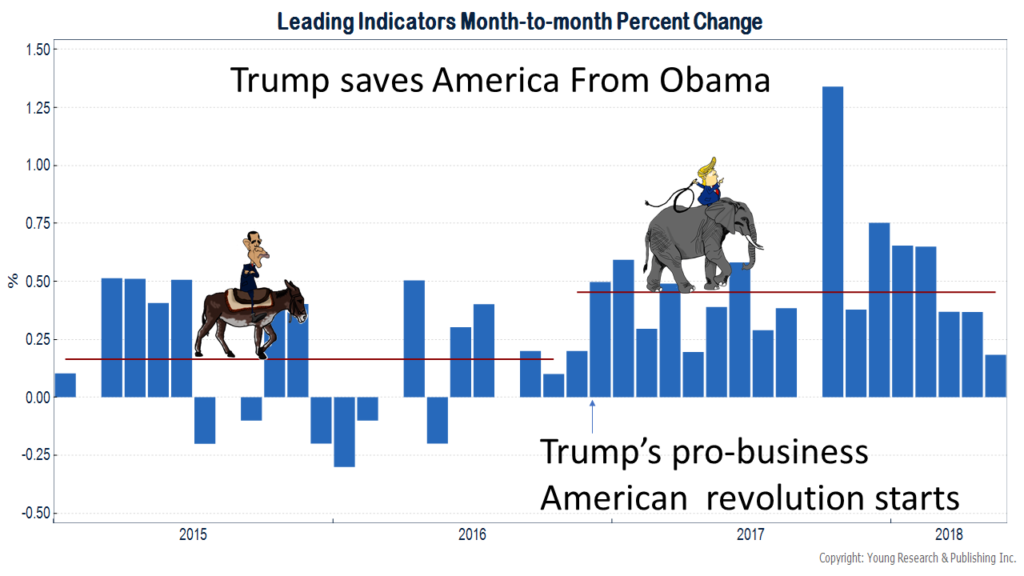

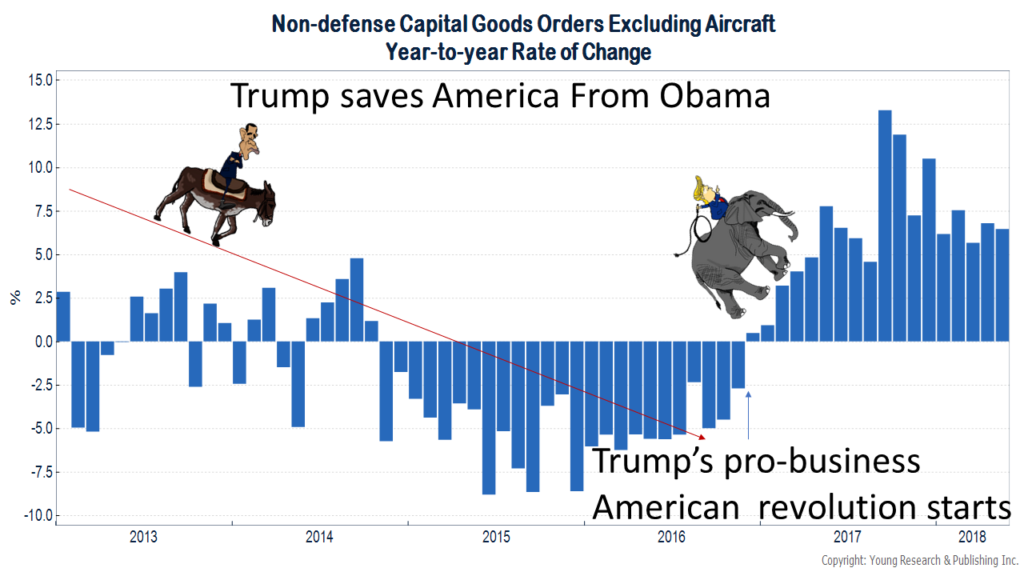

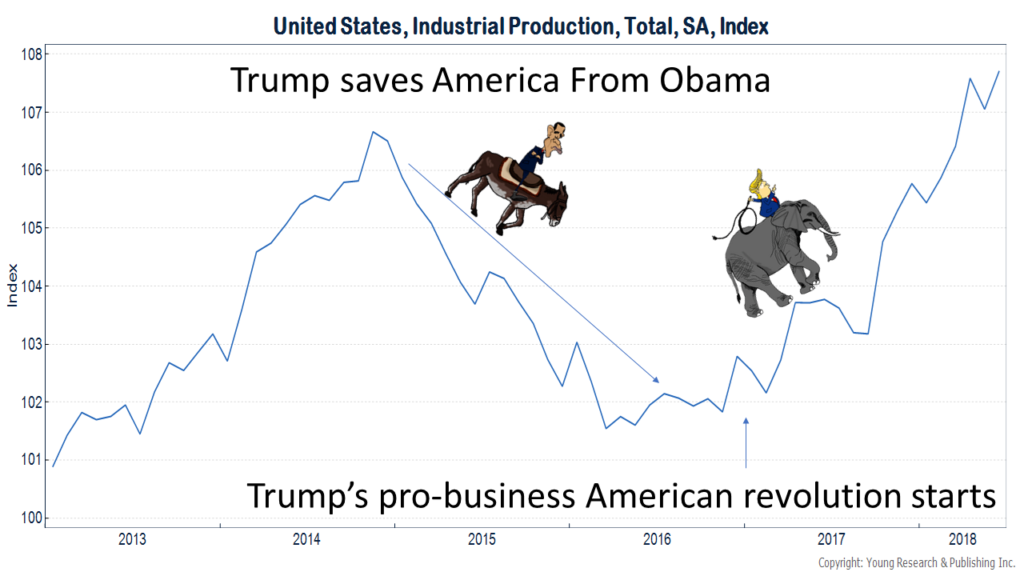

Trump’s Pro-Business American Revolution: Part II

One has to search far and wide to find a single positive headline from the mainstream press about the Trump administration. Trade-wars and foreign policy gaffes dominate the papers, but the story that isn’t being covered well is Trump’s pro-business American revolution.

After eight years of anti-business regulation and rhetoric, U.S. business finally has a spring back in its step. Small business confidence is at some of the highest levels on record, and CEO confidence, even in the face of some disruptive trade rhetoric, remains strong.

The University of Michigan Survey of Consumers shows that the percentage of respondents reporting positive changes in business conditions with respect to government and elections is off the charts. There hasn’t been anything like this on record–ever.

And it isn’t just sentiment that is booming. The manufacturing sector is on fire. Industrial production is humming, the ISM manufacturing survey is strong, and capital goods orders (a signal of business confidence) is also strong. The labor market has almost never looked better and wage growth is on the rise.

The President may not have the polish that some Americans have become accustomed to, but since when has polish ever been a reliable indicator of positive results?

Read Part I here.

Dick Young’s Research Key: Anecdotal Evidence Gathering

Originally posted September 5, 2017.

After a nearly 40-year sabbatical, I am pleased to announce that a newly reconfigured Young’s World Money Forecast is set for its revival. Investors will have a cutting-edge, unique global investment tool that they can draw upon daily.

If your life savings, your business pension fund, or your company IRA program is based on the historical research, writing and advice from Dick Young, you will be off and running with Young’s World Money Forecast (YWMF) back on your side.

YWMF is aimed at investors like you who hold dividends, interest, and compounding front and center in the investing process. I will continue to be on your side as I have been for so many international and domestic investors since my initial YWMF days in 1978. I want you to feel like you are part of an exclusive investment club.

My research and writing for the past 50 years has been built on the twin powerhouse, high-octane engine of inference reading and boots-on-the-ground anecdotal evidence gathering. In 1992, when Debbie and I bought our first legendary Big Twin Harley Davidsons, much of my anecdotal evidence gathering was conducted on two wheels. After 120,000+ miles and more than 25 years on the roadways and byways of North America, we have put the kickstands down on our Harleys for the last time. (They will be auctioned off sometime this fall for a charity event that supports Wounded Warriors.)

Since 2010, Debbie and I have moved much of our anecdotal evidence gathering to Europe, centering on twice-annual research trips in Paris. We just returned from a two-week sweep through France, the Baltics, Scandinavia, and St. Petersburg, Russia. Talk about a shocker of a trip, which I’ll get into in my upcoming e-missives. It ain’t what you read.

To receive an instant announcement of the eagerly awaited return of Young’s World Money Forecast, sign up here. And, of course, you are under no obligation or risk. We do not release our roster of names of club members to anyone—ever. After all, that’s the advantage of a private investment club—integrity and privacy.

Membership in Dick Young’s unique club for serious international investors will cost nothing—not today or ever. Why is that? Because there’s nothing I love more than researching and analyzing for our investment management company on the ramifications global affairs and politics have on safe, sensible investing. What I hate more than anything is the hype, unethical advice, and pie-in-the-sky greed foisted on investors.

You have been with me for many years, if not decades, and I appreciate the thoughtful notes I’ve received over the course of our time together, especially recently with my retiring from writing Richard C. Young’s Intelligence Report. I thank each of you.

I am inviting you to join my exciting new investment project. After 40 years, it’s liberating not to be tied down to a monthly deadline with its archaic snail-mail delivery system and resulting delay. From the time I finished writing and the publisher fact checked, formatted, and sent the issue to the printer, it took nearly two weeks before subscribers received IR.

With YWMF, you’ll get the latest in my thoughts on world affairs/investments as they happen. It’s just that easy. And I nearly forgot to mention, in this escalating age of social media and Internet intrusion, you’ll never see an outsider’s annoying pop-up ad/video/jiggling whatever on my new YWMF website. No outsiders allowed!

Welcome aboard.

Warm regards,