After the inauguration of Joe Biden, and the loss of Senate control to Democrats, Republicans may feel like the end has come. It hasn’t.

Politics is cyclical. A party gets elected in a wave of support, it becomes complacent, ignores its mandate, and is replaced by another party that has impressed the people with its promises. Over, and over again.

Not so long ago the GOP was in much worse straits. In 2008, after the election of President Barack Obama and Democrats’ landslide victories in the House and Senate, pundits were saying that the GOP was over for good, and that the party would never win control of anything ever again.

After a short time living under the Obama administration, Americans began to regret their votes of 2008.

As early as 2009 Democrats’ popularity began to crack. A group called the TEA Party was forming all over the nation, and in early 2010 their energy coalesced when Scott Brown, a Republican, won a special election for the Senate seat vacated by the death of Ted Kennedy, in the deep blue state of Massachusetts.

That election was the first of many that would bring Republicans complete control of the government by 2016.

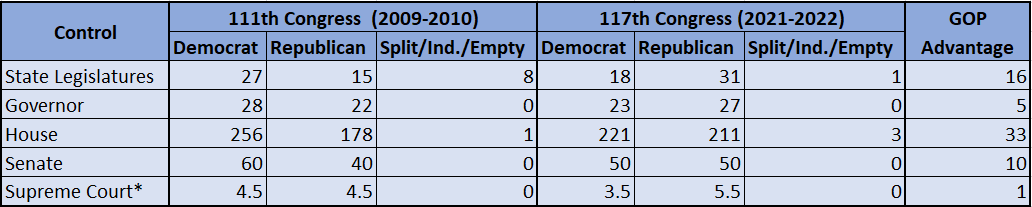

Compared to 2009 when Democrats controlled so many seats, today’s picture is nowhere near as precarious for Republicans. Take a look at the table below comparing the peak of Democrat control during the 111th Congress to the balance of power during today’s 117th Congress.

*Counting swing vote Justice Anthony Kennedy as half Dem half GOP in 2008, and Chief Justice John Roberts as half and half in 2021. Copyright 2021: Young Research & Publishing

Today the GOP owns more legislatures, more governorships, more congressional seats in both houses, and has placed more Supreme Court* picks than in 2008 by far.

The truth is, once Americans see what Democrats have to offer in real life, they no longer want it.