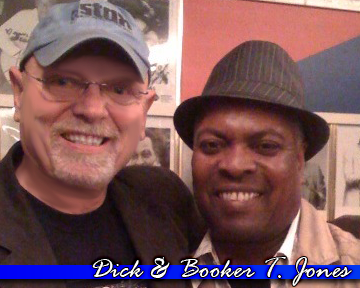

ATLANTIC OCEAN (July 16, 2011) Aviation Machinist’s Mate Airman Matthew Kephart observes an F404-GE-402 jet engine on a test cell as it is fired up on the fantail aboard the aircraft carrier USS Dwight D. Eisenhower (CVN 69). Dwight D. Eisenhower is underway conducting carrier qualifications.(U.S. Navy photo by Mass Communication Specialist 3rd Class Nathan Parde/Released) 110716-N-AU622-029

Profits are rising at GE as demand for its jet engines and power equipment remain strong. The company’s CEO Larry Culp, has planned a number of spinoffs to what was once America’s most renowned conglomerate. Thomas Gryta reports in The Wall Street Journal:

General Electric Co. GE 0.52%increase; green up pointing triangle reported strong demand for its jet engines and power equipment in the fourth quarter, lifting the manufacturer to a quarterly profit and higher revenue than a year ago.

The final quarter of the year is typically the strongest for the company, which generated cash flow of $4.3 billion in the period, bringing its total to $4.8 billion for the year. The latest results include GE HealthCare Technologies Inc., GEHC 0.52%increase; green up pointing triangle which it spun off in early January.

The company had a fourth-quarter profit of $2.1 billion on a 7% increase in total revenue to $21.8 billion. The earnings results topped Wall Street’s expectations. GE forecast higher revenue for 2023 but set a cash flow target for the year below some expectations after the healthcare spinoff. GE shares ended Tuesday up 1.2% at $80.70.

Inflation continues to be a challenge across the businesses, Chief Executive Larry Culp said in an interview, and isn’t expected to go away in 2023. Pricing has caught up to cost increases, he said, and will be about neutral for the year. “That is more of a function of us doing a better job of combating it than inflation going away,” he said.

The company is laying off about 2,000 workers from its onshore wind business, it has previously said, but is hiring elsewhere in the company. The aerospace division cut 25% of its workforce in 2020 as pandemic lockdowns hit the aviation industry but is now searching for workers as growth increases.

“If you know any welders or machinists, send them my way,” said Mr. Culp, who is also the CEO of the aerospace division.

GE began the year by splitting off its healthcare unit, completing a key step in the breakup of the American icon which is now focused on GE Aerospace, its jet engine division, and a portfolio of energy businesses that will become a separate company called GE Vernova in 2024.

GE projected free cash flow between $3.4 billion to $4.2 billion for 2023, an estimate that may adjust over the year. In the middle of 2022, GE cut its projections by about $1 billion from the $5.5 billion to $6.5 billion it had previously predicted.

The company expects operating profit of $5.3 billion to $5.7 billion for GE Aerospace for the year and an operating loss of $600 million to $200 million for GE Vernova.

The spinoffs are designed to simplify GE’s operations and make the assets more attractive to investors. Mr. Culp has said the breakup will bring more focus and accountability to the business he has revamped since 2018.