Many investment gurus, panelists, and wunderkinds attempt to prove, day in and day out, that they are smarter than the market. Often they suggest that if you simply buy when they buy, and sell when they sell, you will have investment success.

But reality is that most of the time, such market timing behavior leads investors into playing a losing game of catch up. They often end up chasing the market and buying near the high, then selling near the low for the same reason. In 1992 I warned readers about the dangers of trying to outguess the market. I wrote:

How many investors are lucky enough to trade correctly to catch just 30 months out of 600 months? Come on, the odds are real poor. If you stay fully invested, however, you cannot fail to capture all of the good months. Sure, you’ll ride out some tough times. The stock market is high today based on value—no doubt about it. That was also true in 1987, when stocks got clobbered in the autumn of 1987. But the rebound from the 1987 lows was swift, and precious few investors sold pre-crash and got back into the market in a timely fashion.

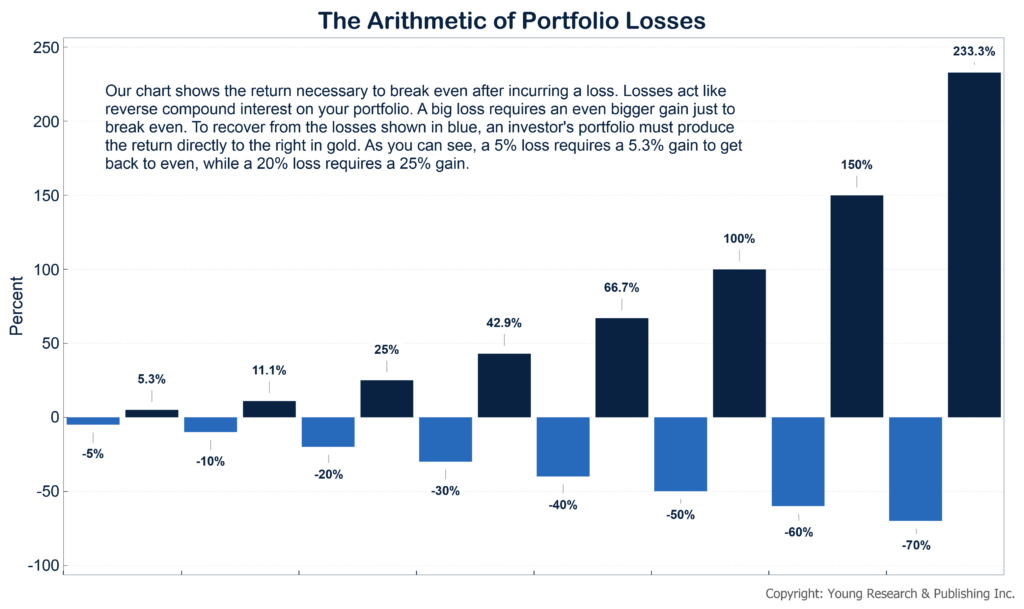

Your defense against the volatility of the market is not to attempt some casino-like strategy of moving in and out. Instead, craft a diversified investment portfolio of stocks and bonds that provide comfort and confidence in bull markets as well as bear markets. Suffering massive losses in your portfolio due to a bad market timing call can be devastating.

Take a look at my chart on the Arithmetic of Portfolio losses below. You can see that after a 30% loss in your portfolio, you’d need a 42.9% gain to break even. And after a 50% loss you would need a 100% gain. Those are not easy returns to produce, and to be sure it would be best not to lose so much in the first place.

Don’t try to outguess the market. Instead, seek to craft a portfolio that will support you and your family in and out of bull markets, corrections, or even collapses.

If you need help crafting such a portfolio, please sign up for the Richard C. Young & Co., Ltd. client letter (free even for non-clients) written by my son Matt. The letter will give you an idea of the measures our family investment counsel firm puts into place for our clients’ portfolios. Hopefully those strategies will allow you to become a more successful investor.