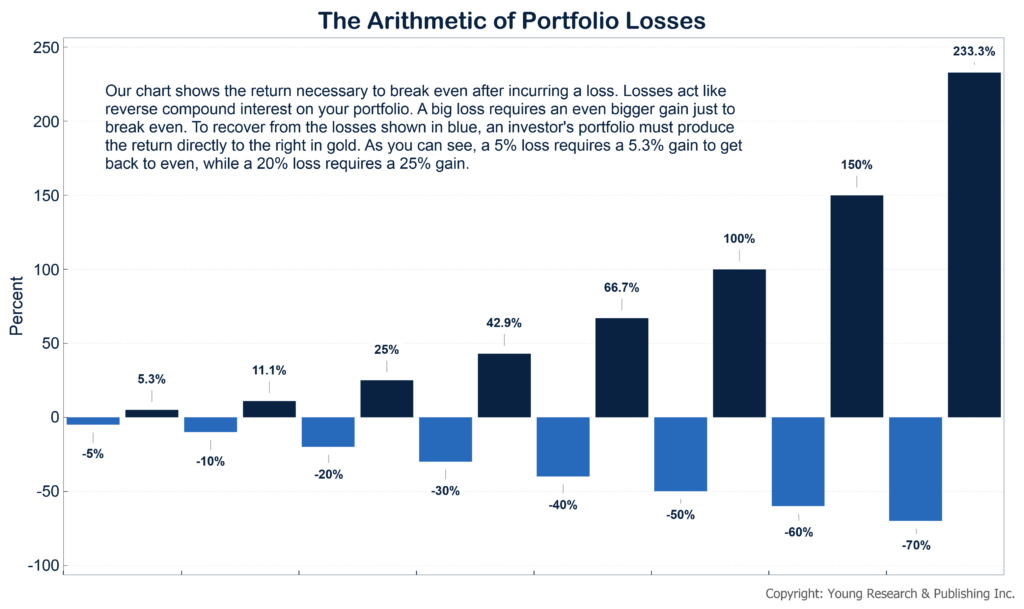

Can you double your money in a year? Not many people can. But if you lost 50% of the value of your portfolio, that’s exactly what you would need to do just to make it back to even.

If the prospect of trying to double your money sounds unappealing, I suggest you try not to lose that much in the first place. On this topic, I wrote in November 1994:

Unchanged Since the Twenties

According to BBC television, the Classic Coke bottle, the VW Beetle and AGA Cooker are the three finest industrial design achievements of the 20th century. You know the Classic coke bottle, you know the VW Beetle, but the AGA Cooker?

Contemporary stoves pale by comparison to this handcrafted, cast iron cooker that quickly becomes the heart and soul of any kitchen it inhabits. Available in a handful of vibrant enameled color, the heavily insulated, gas-fired AGA has no temperature controls and is always on.

In most kitchens, 80% of cooking is done on the stove top and 20% in the oven. With an AGA, the reverse is true—80% or more is done inside. Externally vented ovens prevent cooking smells from returning to the kitchen, while gentle radiant heat produces superb cooking results—never, ever dried out.

The AGA works on the principle of stored heat within the well-insulated cooker; your job is to simply choose the temperature you want from one of four separate ovens.

This timeless, handcrafted work of beauty, functionality and simplicity was designed over 70 years ago and remains virtually unchanged since the 1920s. For more info on the incomparable AGA Cooker, [visit www.aga-ranges.com].

Timeless describes the AGA’s design, and timeless is the first word I use to describe my investment principles for you. I hope you will embrace my timeless set of investment principles; they will allow you a lifetime of investment rewards.

As a serious, long-term investor, I want you to always consider risk before profits. Never forget, when you lose 50% on an investment, you must double your money next time out just to get even. And even then, you have earned zero return.

Reducing risk in your portfolio is the best way to prevent wild swings that could generate losses you can’t come back from. Focusing your efforts on diversification, dividends and interest, and on companies in industries with high barriers to entry can help you reduce risk in your portfolio. It’s hard to double your money in a year, but it’s easy to get started on reducing risk in your portfolio today.