There’s nothing more important to your investment success than protecting your principal. Capital gains will come and go, but losing the money you worked hard to earn is like taking a direct hit from a Scud missile. You need to build a tactical battle plan to kill the enemy—in this case, risk—and to win. Here’s the battle plan I laid out for readers shortly after Operation Desert Storm, and I remain committed to it today.

You’ll Be The Big Winner!

General Norman Schwarzkopf built the allied forces military victory in the Middle East on diversity. Schwarzkopf did not go into battle single-handed. Given the mental make-up of Saddam Hussein, the American general had no idea what might be launched at him. So he skillfully deployed a wide array of weapons—from the A-10 Warthog and Apache helicopter to the Patriot Missile to the M-2 Bradley fighting vehicle and the M-1 battle tank and the F-15 Eagle fighter bomber—and victory was achieved. Fortified with his arsenal of blue-chip weapons, Schwarzkopf, the master tactician, was prepared for any type of adversity.

YOU NEED A TACTICAL BATTLE PLAN

Your tactical battle plan for investment success should be patterned after Schwarzkopf’s strategy in the Middle East. Plan well to meet any challenge with an arsenal of investor weapons, and in the end (which is where it really counts) you’ll be the big winner. Of course, you won’t need in your arsenal any A-10 Warthogs armed with 30-caliber Gatling guns. You won’t be going after enemy tanks buried up to their gun turrets in the sand. You won’t need an A-10 Warthog’s massive nose-mounted gun hammering nearly 4,000 rounds a minute and making, as The Wall Street Journal’s John Fialka noted, a sound “like a gigantic zipper as it atomizes its targets.” No, you won’t need quite the same weapons. What you will need is a carefully crafted investment arsenal assembled to carry you through all types of investment market conditions.

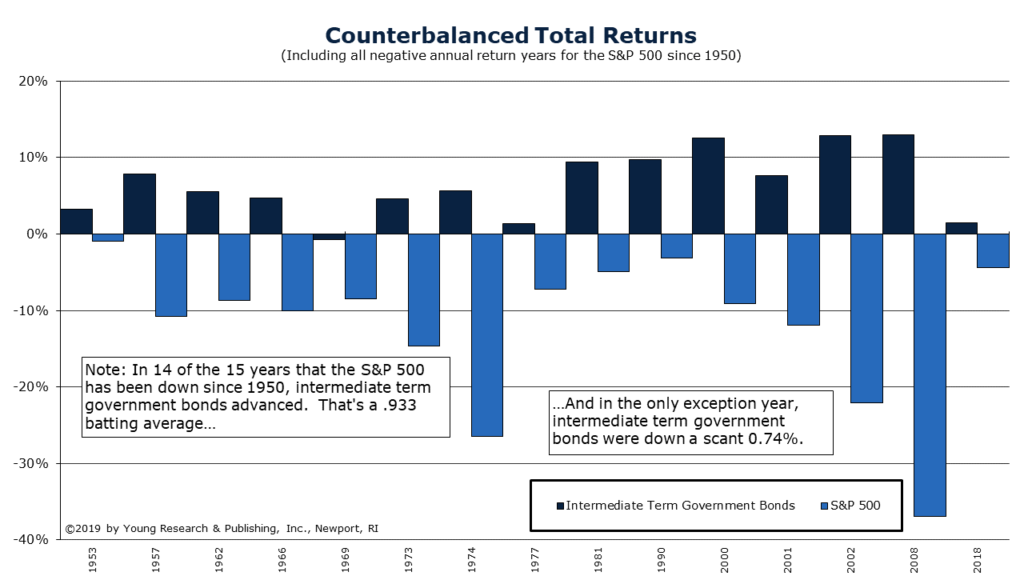

To protect your principal, you want to fight risk wherever you find it dug in. The arsenal you need to do that is an internationally diversified stock portfolio focused on dividend-paying stocks like my Retirement Compounders® program, and a bond portfolio filled with bonds backed by the full faith and credit of the United States Treasury, as well as investment-grade corporate bonds picked just for you. You’ll want the air support of a precious metals component to act as an insurance plan for any surprises that happen in your investment war.

If you want to learn more about how these tools are used while managing portfolios at my family-run investment counsel firm, click here to sign up for our monthly client letter (free even for non-clients).