From August 15, 1971, the day President Nixon officially took America off the gold standard (the system had been breaking down for years beforehand) to September 17, 2007, the day before the Ben Bernanke-led Federal Reserve began what would be an unprecedented economic intervention in the face of the Financial Crisis, the mean interest rate of 3-month T-bills was 6.08%. For the 18 years following Bernanke’s intrusion on markets, it’s been 1.39%.

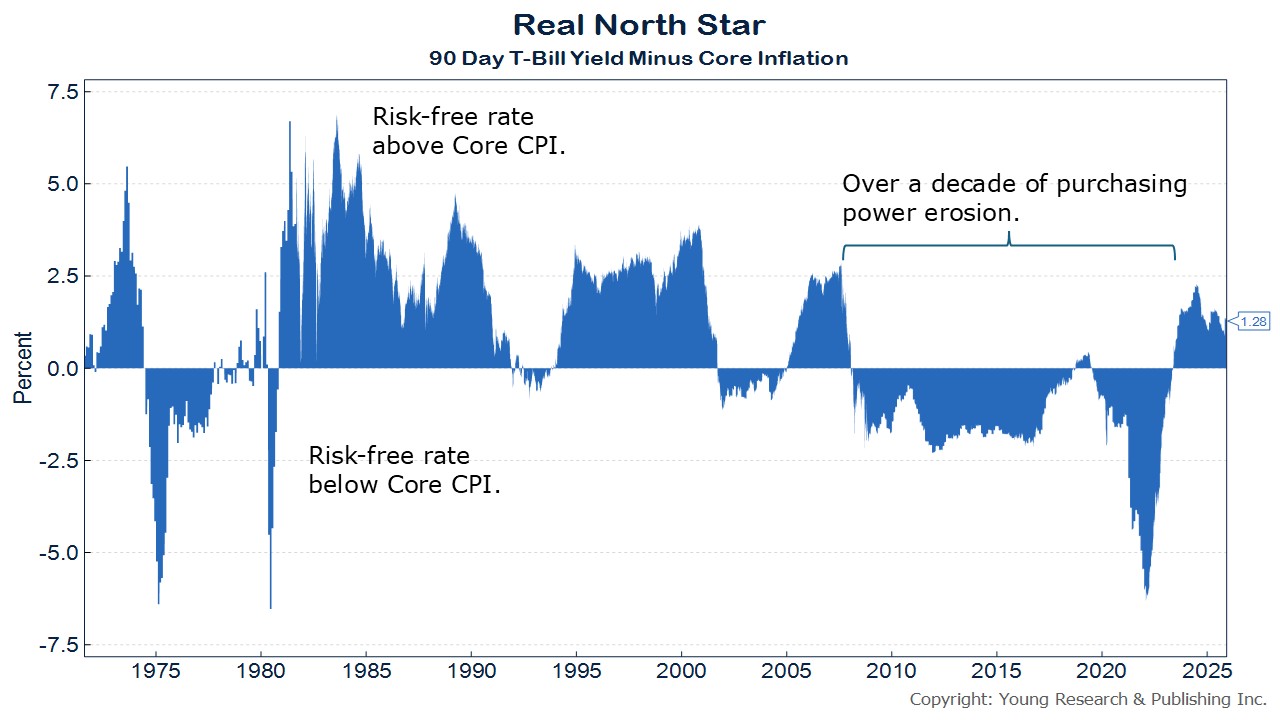

For decades, I have called the 90-day T-bill the investor’s “North Star.” The T-bill is the risk-free rate of return you can use to chart your course among other investments. The “Real North Star” is the risk-free rate of return with inflation taken out. It’s a measure of the growth or decline in Americans’ purchasing power.

During the pre-Bernanke era, the yields on T-bills rarely fell below the rate of core CPI inflation, and then only for brief periods. Since Bernanke’s response to the Financial Crisis, yields on T-bills have spent more time below the rate of core inflation than above.

Low rates are harmful for savers. When the Fed pushes short rates below 4%, investors should be wary. Here’s how I explained it in 2003:

The 90-day T-bill is often referred to as the risk-free rate of return. Here we are looking at ultimate safety. In retirement, I advise you to draw no more than 4%. When T-bills are 4%, and ideally 4% plus the current inflation rate, you can invest defensively with ultimate safety and a satisfactory, if not munificent, return. When the T-bill rate is below 4%, you cannot make your draw. As such, you are knocked out of the box with the ultimate safety investment. That’s a big deal, no way around it. Aggressive investors and know-it-alls eschew T-bills as dull and boring and certain to produce modest results. Well, all of that is true, but you know what? So what? You can win the day with (1) no credit risk, (2) no interest rate-cycle risk, (3) no stock market risk. You’ll sleep well at night. No, you won’t get rich on your investments, but when you already have your nest egg, you just may not need to get a whole lot richer. With the North Star today at 1.1%, red lights are flashing in a really big way.

The recent release of minutes from the last meeting of the Federal Open Market Committee showed that Federal Reserve officials are internally debating the efficacy of future interest rate cuts. The Federal Reserve should be cautious about lowering rates further than it already has. The Real North Star is still in positive territory, but every cut brings investors closer to losing purchasing power on the risk-free rate. The last thing Americans need after years of Bidenflation is further erosion of their purchasing power.