The liberal electronic and print media will shortly be howling – with cartoon-size bold headlines – about dividend cuts.

We just began the second quarter of the year. Third-quarter earnings reports will, thanks to the lying Chinese, be breathtakingly ugly. And the media will be out in full force glomming on to disruption.

Words like recession and depression will fill the media channels. Greedy and grasping stockbrokers will be out, in full-scale hyena mode, yelling, “sell, sell, sell.”

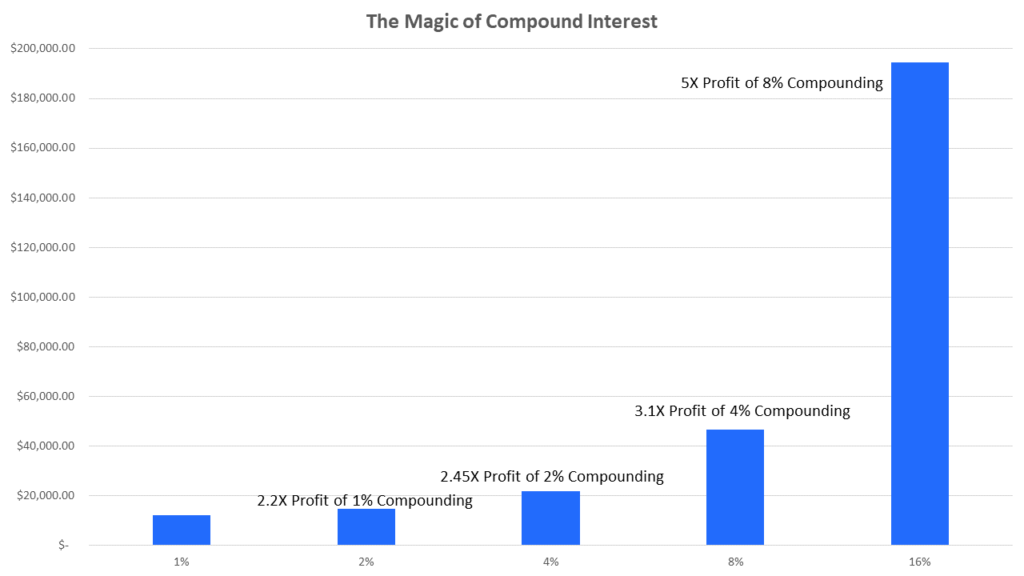

Serious, long-term, compound interest focused mavens will follow my lead by engaging in a quiet, month-long reallocation of assets.

Dick Young – a Compound Interest Maven

During the month of March, I positioned myself to accumulate assets others were eschewing or dumping en masse. Included on my watch list are stable long-term dividend payers temporarily placing their dividend payouts on holiday. Makes good sense to me. Business conditions are easily weak enough to make such a short-term stabilizing strategy a wise move.

Make it as good a day as you can.

Thanks to Donald Trump’s foresight on the scourge that is China, the folly of open borders, the mathematical naiveté of free trade, and the “America Last” fraud of globalization, America will snap back like a catapulted Navy Super Hornet off a carrier deck.

You can count it.