Model Guidance: No Changes for the Week

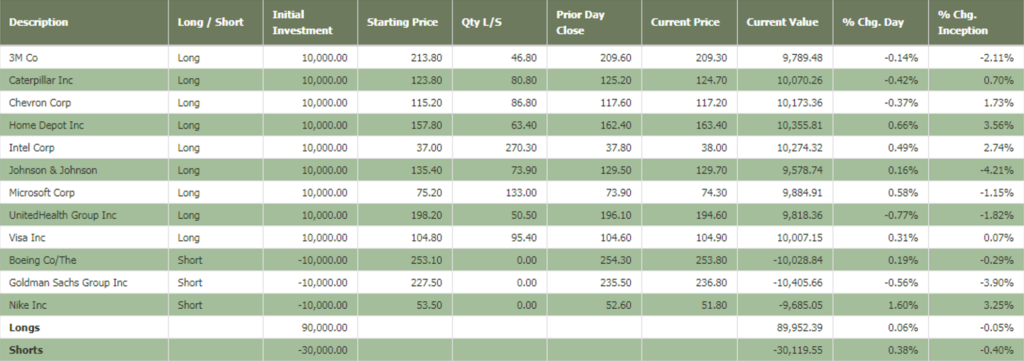

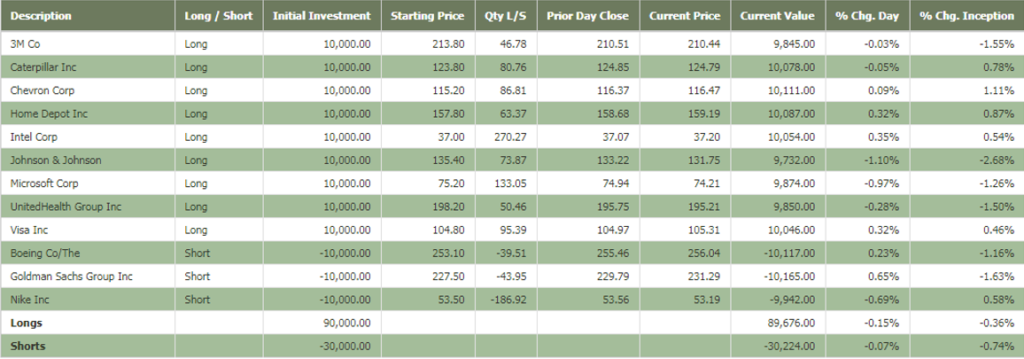

My short-term Bull & Bear Portfolio consists of 9 equally-weighted long positions and 3 equally-weighted short positions. Both the long and short stocks are selected from the Dow Jones Industrial Average. If the Dow advances over the period in which my 12-Dow stock portfolio is open, the model will make money with the stocks that advance and will lose money with the stocks that decline. And the opposite will prevail for the short stocks. Each week, I will review the model portfolio for potential changes. If no changes are required, I’ll simply post no changes for the week. You can read more about my Bull & Bear Portfolio here.

Featured Analysis:

Earnings reports are coming in from the big Dow companies I have advised as long positions in my Bull & Bear portfolio. I don’t spend any time worrying about companies “beating” estimates, or achieving artificial guidance benchmarks created by management to control Wall St. analysts’ opinions. What is helpful though are the actual details about the business you may glean from an earnings report. Here are a few I’d like to share from the recent earnings season.

3M: The business with the best momentum in the last quarter at 3M was its electronics and energy business. Particularly strong was 3M’s displays unit. 3M builds multi-touch projected capacitive (PCAP) display systems that can be from 7 inches to 65 inches wide. The glass is bezel-free, for the glass-to-edge designs you see on the most advanced technologies. The PCAP systems use 3M’s proprietary Ultrafine Metal Mesh designs to get accurate responsive behavior from display screens. 3m debuted its 65”, 4k ultra-high definition display last year at a tech gathering known as InfoComm. The machine is targeted at large public venues and retail applications. 3M’s innovative technology has always kept it ahead of its peers.

Caterpillar: A highlight in Caterpillar’s last quarter was strong sales in China. After getting completely shut out of China in the 1950s and 1960s, Caterpillar returned to the Middle Kingdom in 1972, after a 23 year absence. The reopening of China’s doors to Cat employees revolved around an order for 38 pipelaying machines and replacement parts the Chinese wanted to buy. Now, years after that humble start of 38 machines, Caterpillar has sold in the first eight months of 2017 over 85,000 excavators, according to the China Construction Machinery Association. And Cat has recently unveiled its next generation of hydraulic excavators at a Beijing trade show. Sales of mini-excavators are doing so well in China that Caterpillar is planning on increasing capacity at its Chinese production facility.

Microsoft: The story this quarter at Microsoft was all about the Cloud. Sales of Microsoft’s Azure cloud system increased by 90%. Without getting too technical, Azure is a cloud system used by app developers to build and deploy their creations on Microsoft’s servers around the world. Azure is a direct competitor to Amazon’s Web Services (a.k.a. the profitable part of Amazon). After getting a late start in the cloud, Microsoft has come roaring back to amass loads of market share. Unlike Amazon, Microsoft is a Dividend Achiever with over a decade of consistent dividend increases under its belt.

Intel: In the company’s third quarter earnings release Intel CEO Brian Krzanich said the company’s product-line is “the strongest it has ever been.” He singled out markets like artificial intelligence and autonomous driving as places Intel is focused on innovating. Intel is building a new chip called Nervana to supply the booming demand for artificial intelligence technology. The Nervana is a neural network processor (NNP), and Intel has been developing it for over three years. Naveen Rao, who began the Nervana project before it was acquired by Intel said of the work the chips will do “Machine Learning and Deep Learning are quickly emerging as the most important computational workloads of our time.” Existing hardware just won’t cut it under these new demands. Rao continues “We designed the Intel Nervana NNP to free us from the limitations imposed by existing hardware, which wasn’t explicitly designed for AI.”