Model Guidance: No Changes for the Week

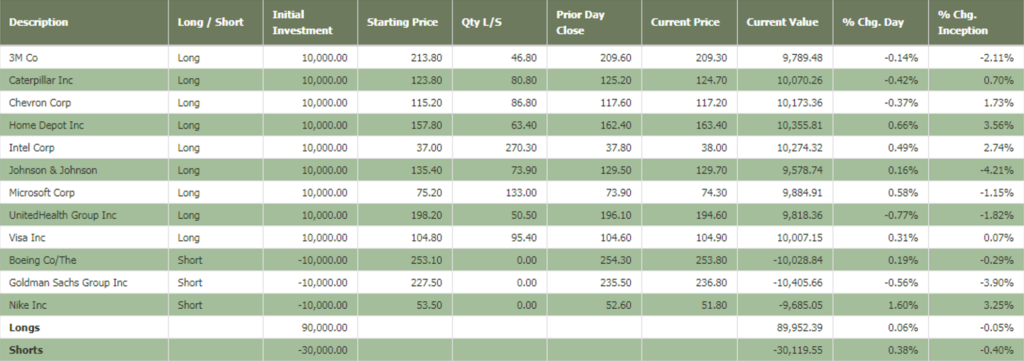

My short-term Bull & Bear Portfolio consists of 9 equally-weighted long positions and 3 equally-weighted short positions. Both the long and short stocks are selected from the Dow Jones Industrial Average. If the Dow advances over the period in which my 12-Dow stock portfolio is open, the model will make money with the stocks that advance and will lose money with the stocks that decline. And the opposite will prevail for the short stocks. Each week, I will review the model portfolio for potential changes. If no changes are required, I’ll simply post no changes for the week. You can read more about my Bull & Bear Portfolio here.

Featured Company: Microsoft (NASDAQ: MSFT)

Back in 1975 two young men, Bill Gates and Paul Allen, founded a company they named Mircosoft. That year the two made their first sale to MITS Computer. The company purchased a PC programming language called BASIC. In 1981 Microsoft was incorporated, and IBM adopted its 16-bit operating system for its first personal computer. In 1985 Microsoft would introduce Windows 1.0. The operating system was the first in a family of operating systems that would expand in usage across most of the computers in the world. In 1990 Microsoft became the first PC software firm to generate over $1 billion in sales in a single year.

In tandem with its ubiquitous operating system, Microsoft has developed and acquired a number of software programs that have come to be known collectively as Office. The Microsoft Office Suite of programs, including Word, Excel, PowerPoint and others, is found on almost every computer used for real work. Office has been a powerhouse performer for Microsoft. When misadventures like the Zune mp3 player let shareholders down, Office held steady.

Now Microsoft is integrating Office into its next big endeavor, the Cloud. Microsoft’s cloud systems, led by its Azure application platform, is one of the fastest growing parts of the company. The cloud is the future, and Microsoft is a leader. With more companies adopting cloud services to increase their efficiency and redundancy, Microsoft is once again sitting at the leading edge of a technological plate shifting. Unlike many other tech companies though, Microsoft has developed a strong dividend record. MSFT shares have paid dividends since 2003, and have increased them each year for the last 12 years. Over the last five years dividends have grown at an annualized rate of 14.3%.