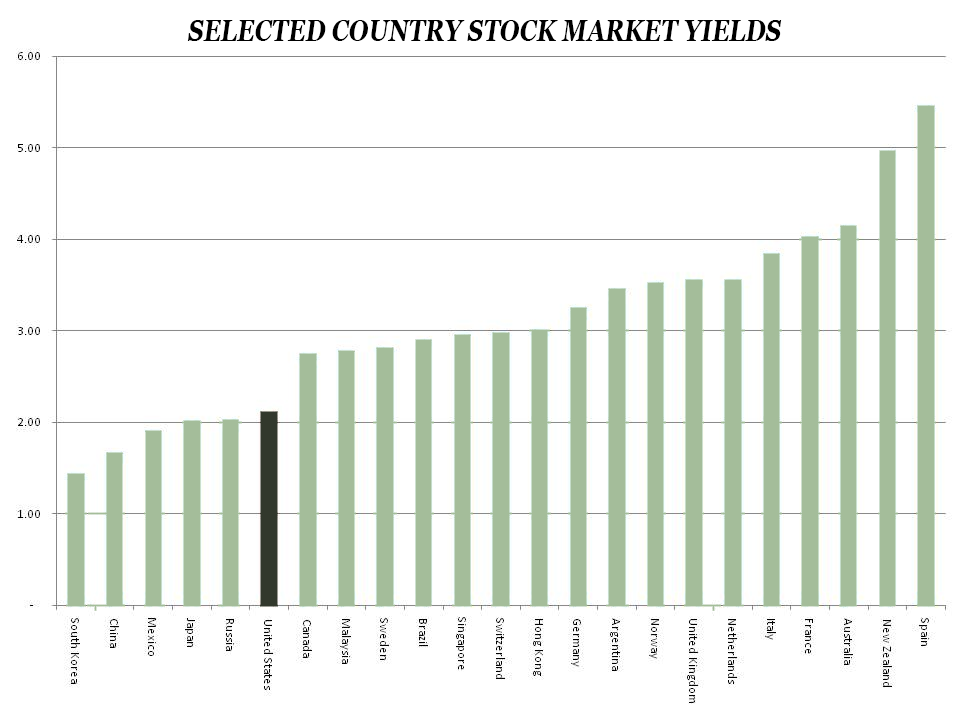

Do you invest in stocks for income? Is your portfolio focused primarily on U.S. stocks? If so, you might consider diversifying globally. The dividend yield on the U.S. stock market is one of the lowest yields in the world. In the chart below, I show the yields of 23 of the world’s major stock markets. The dividend yield on U.S. stocks is only 2.11%, compared to an average of 3.09% and a high of 5.45% in Spain. The U.S. is the sixth-lowest-yielding stock market in the group. If you invest in stocks for dividends or income, a global approach is advisable.

When you take a global approach to dividend investing it is possible to craft a portfolio that is better diversified across industries than a U.S.-only portfolio. Take the U.S. oil and gas industry as an example. Oil and gas production is a capital-intensive business. In the U.S., the independent oil and gas companies fund their capital expansion projects primarily with internally generated funds. After capital expenditures, there is often not much cash left for dividend payments. But in a country like Canada, there are oil and gas production companies that offer high dividend yields—in some cases yields north of 5%. How do the Canadian oil and gas companies pay such high dividends? Instead of funding capital expansion plans with internally generated funds, they tap the capital markets. For income-oriented investors, the strategy has appeal.

In Young Research’s Global Investment Strategy, we advise high-yielding international stocks that you’re unlikely to find in any other investment strategy report. We also cover special situations, global fixed-income markets, and commodities and currencies. If you are not now a subscriber, please join us.