Today, you can lend $10,000 to the U.S. government, which just closed its books for the year with a deficit of almost $1 trillion, and lock in an income stream of about twelve dollars per month for the next decade.

That’s enough to treat yourself and the wife to a couple of Big Macs once a month. But if McDonald’s keeps raising prices, a couple of years from now, you may need a buy-one-get-one coupon to treat the wife.

The interest payments on government bonds are fixed, and are so tiny today they don’t even keep pace with the massaged inflation numbers reported by the Labor Department.

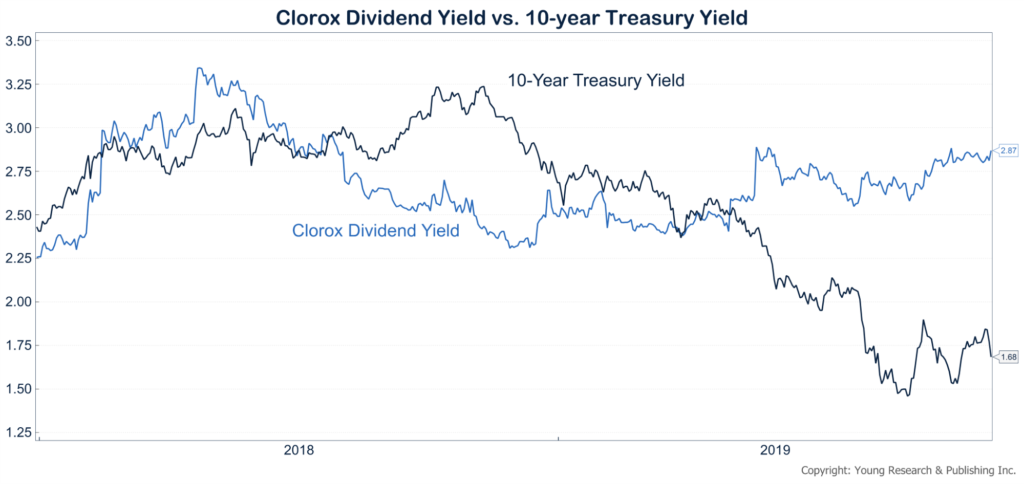

Of course, nobody is forcing you to lend the Treasury Department money. The savvier choice might be to invest $10,000 in shares of Clorox. Clorox will pay you double what the Treasury Department is willing to fork over, and they will likely give you a pay increase every year you are a shareholder.

Filet and lobster won’t be on the menu, but you might be able to afford a joint with sit-down service.

The chart below compares the dividend yield of Clorox to the yield on 10-year government bonds. The trade-off today is an easy one.