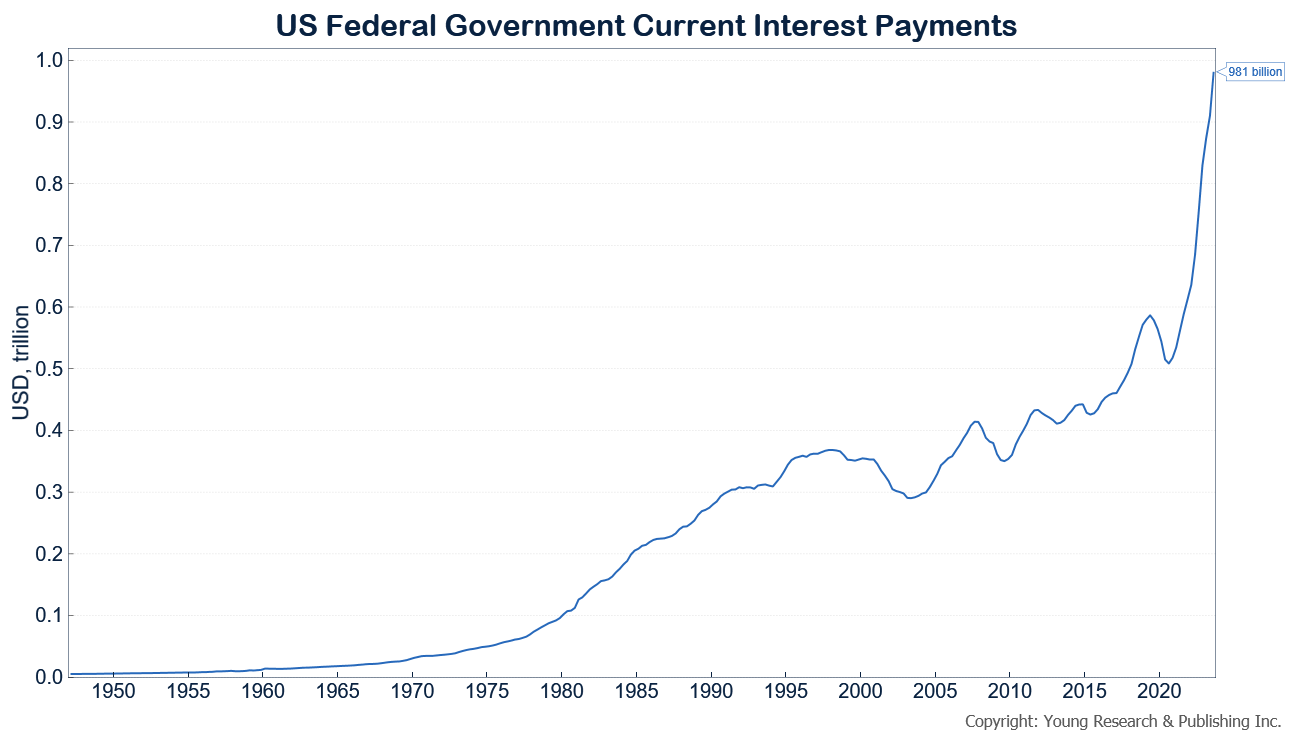

Since the “temporary” stimulus package of 2009 was enacted by Barack Obama and greased through the system by Ben Bernanke’s Federal Reserve, Americans have faced ever more burdensome budget deficits. After Joe Biden moved into the White House, the dangerous spending reached a new level. Uncontrolled money printing has set America up for some hard lessons as the interest on the federal debt rapidly closes in on $1 trillion a year.

This time around, the Federal Reserve isn’t running a bond-buying program while pegging interest rates at zero. Instead, the Obama/Biden-style spending will be forced to face the music on interest. Now, after years of profligate spending, Joe Biden has put America’s treasured credit rating at risk. On Friday, November 10, 2023, Moody’s Investors Service cut its outlook on U.S. sovereign credit to negative from stable.

In January of 2012, I wrote about the Obama-era downgrades of America’s debt in the Fall of 2011:

The international financial landscape today is far different than at any time in the past. I mean a lot different. Due to profligate mismanagement by our politicians in Washington, the U.S., for the first time in history, has lost its AAA-credit rating. Meanwhile, the Fed is pouring more and more high-octane fuel into the economic engine with increasingly foul results.

The downgrades are a symptom of the real problem, which is too much spending. Since inflation laid bare how badly accommodating Federal Reserve policy can mess things up, Biden’s overspending is exposed for the danger it is. Moody’s, S&P, Fitch, and all Americans will inevitably have to recognize the danger in Biden’s debt-fueled spending binge. Perhaps they will even do so before it’s too late.