For over four decades I have used a simple strategy to successfully invest in the stock market. I invest exclusively in dividend paying stocks. I especially favor those with high yields, a strong balance sheet, and a history of annual dividend hikes. This strategy is simple, but it works.

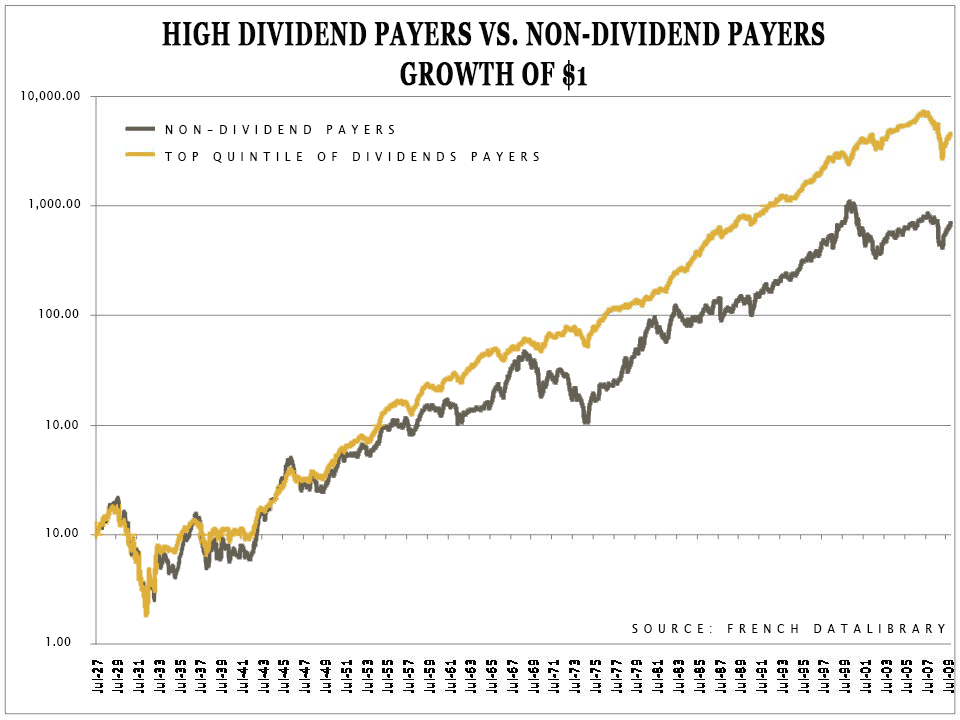

Historically, high dividend payers have outperformed non-dividend payers. In the chart below I show the growth of $1 in non-dividend paying stocks to the growth of $1 in the highest yielding quintile (top 20%) of U.S. stocks. The difference in performance is profound. $1 invested in non-dividend payers in June of 1927 grew to $696. That same dollar invested in the highest quintile of dividend paying stocks rebalanced each year, grew to over $4,500.

You may study my chart and wonder why any investor would bother with non-dividend payers. This strategy is not complicated. Anybody with access to a financial database and some time can run a few screens and come up with a list of candidates to buy. As I see it, the reason more investors don’t focus exclusively on dividend payers is because they lack patience. Building wealth in dividend paying stocks is a slow process. Most high dividend payers are mature stable businesses with modest growth prospects. They don’t offer the prospect of spectacular short-term gains. With dividend payers, you profit over the long-term through the power of compound growth. That requires patience.

At Young Research my Retirement Compounders list includes only dividend paying equities. Today, the average dividend yield on the RC’s exceeds 5%–more than twice the yield on the S&P 500. Young Research’s Retirement Compounders forms the basis for the stocks I recommend in Intelligence Report and the equity portfolios we manage at my family-run investment company.

If you are interested in having a portfolio of global dividend paying equities managed check out younginvestments.com.