You need to have some will-power to stick to your guns in this stock market. No one said it was going to be easy. But to allow the magic of compound interest to work for you, you have to be patient. Here is one of the great lessons I love to read over and over again from the late Richard Russell. Mr. Russell passed away in November at the age of 91. He wrote daily to his beloved subscribers right to the bitter end. I miss reading his daily thoughts on the market and, even more so, on life in general. RIP Mr. Russell.

Rule 1: Compounding: One of the most important lessons for living in the modern world is that to survive you’ve got to have money. But to live (survive) happily, you must have love, health (mental and physical), freedom, intellectual stimulation — and money. When I taught my kids about money, the first thing I taught them was the use of the “money bible.” What’s the money bible? Simple, it’s a volume of the compounding interest tables.

Compounding is the royal road to riches. Compounding is the safe road, the sure road, and fortunately, anybody can do it. To compound successfully you need the following:perseverance in order to keep you firmly on the savings path. You need intelligence in order to understand what you are doing and why. And you need a knowledge of the mathematics tables in order to comprehend the amazing rewards that will come to you if you faithfully follow the compounding road. And, of course, you need time, time to allow the power of compounding to work for you. Remember, compounding only works through time.

But there are two catches in the compounding process. The first is obvious — compounding may involve sacrifice (you can’t spend it and still save it). Second, compoundingis boring — b-o-r-i-n-g. Or I should say it’s boring until (after seven or eight years) the money starts to pour in. Then, believe me, compounding becomes very interesting. In fact, it becomes downright fascinating!

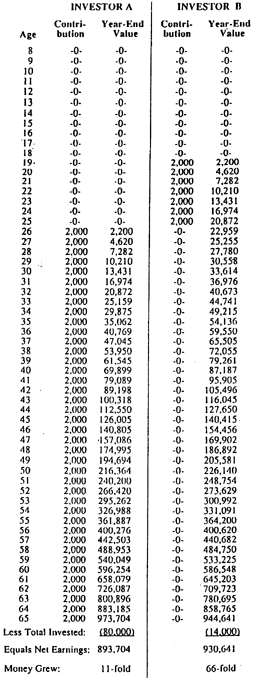

In order to emphasize the power of compounding, I am including this extraordinary study, courtesy of Market Logic, of Ft. Lauderdale, FL 33306. In this study we assume that investor (B) opens an IRA at age 19. For seven consecutive periods he puts $2,000 in his IRA at an average growth rate of 10% (7% interest plus growth). After seven years this fellow makes NO MORE contributions — he’s finished.

A second investor (A) makes no contributions until age 26 (this is the age when investor B was finished with his contributions). Then A continues faithfully to contribute $2,000 every year until he’s 65 (at the same theoretical 10% rate).

Now study the incredible results. B, who made his contributions earlier and who made only seven contributions, ends up with MORE money than A, who made 40 contributions but at a LATER TIME. The difference in the two is that B had seven more early years of compounding than A. Those seven early years were worth more than all of A’s 33 additional contributions.

This is a study that I suggest you show to your kids. It’s a study I’ve lived by, and I can tell you, “It works.” You can work your compounding with muni-bonds, with a good money market fund, with T-bills or say with five-year T-notes.