For over five decades, the underpinning of everything I have written has been a foundation of dividends. It has served me well, and if you have followed my advice, it has served you well too.

Shortly after the dotcom bust, I wrote a segment titled, “Make Dividends Your Ally.” In it, I said:

Regarding dividends, corporate directors have deluded themselves for many years in two ways. First, they have been too concerned about double taxation. Many investors don’t care about double taxation because they are (1) saving in tax-deferred accounts or (2) need the dividend income in retirement. Second, directors believe that management can reinvest earnings so well that it just does not make good sense to pay out much to shareholders in the form of dividends. Nonsense. The track record of reinvestment just isn’t that strong.

Does that template apply to investors today? Yes. A number of today’s biggest companies don’t pay any dividends at all.

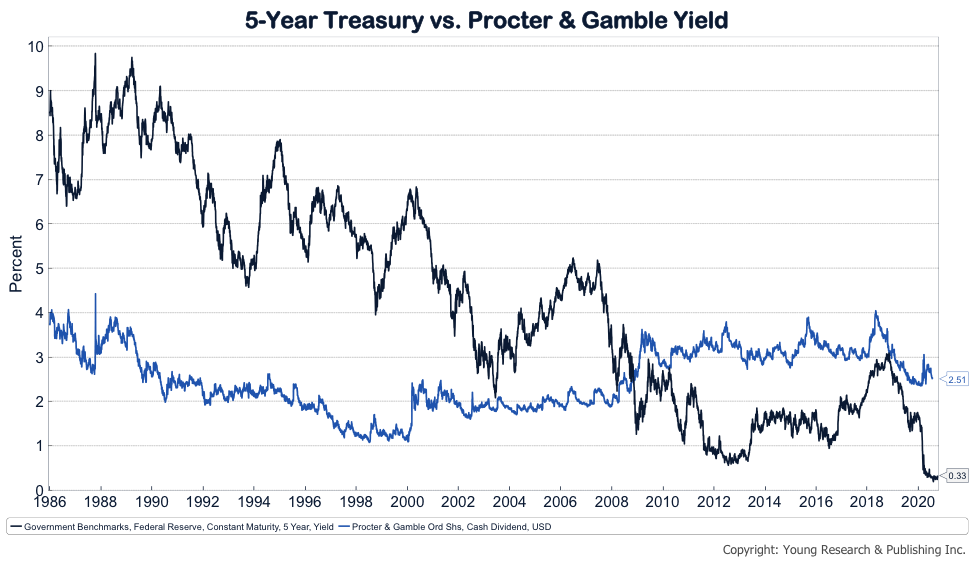

While many investors own equities paying no dividends, the Federal Reserve has lowered interest rates to near-zero levels, again. The 5-year treasury yield you see in the chart below illustrates the dire situation for America’s savers.

Alongside the treasury on the chart is the yield of Procter & Gamble shares. During the last 40 years, P&G has compounded its dividend, on average, 8.5%, and its stock price (not on the chart) by 10.5%. That’s the type of strong record retirees can build a portfolio around when they make dividends their ally.

Make dividends your ally today. For more on the benefits of dividend investing, download Dividend Investing: A Primer from Richard C. Young & Co., Ltd.