UPDATE 6.10.22: Do you feel a recession coming on? Treasury Secretary Janet Yellen just told an interviewer at the New York Times that “Is there a recession risk? Of course there’s a recession risk. But is it likely? I don’t think so.” She also said, “I believe there is a path through this that entails a soft landing.” Meanwhile, most CEOs, the World Bank, and the Fed’s own GDP tracker suggest the opposite. Who’s correct? No one can know for sure, but it’s important that your portfolio is prepared for any outcome.

UPDATE 3.11.22: Market turbulence today once again supports the value of an investment strategy based on compound interest and dividends. While stock and bond prices oscillate wildly as events unfold, investors relying on dividend and interest payments are patiently accruing wealth.

Originally posted March 11, 2020.

There are few histories as crucial to the course of my life as my awakening to the power of compound interest and the importance of dividends. Since my decision to climb on the dividend bandwagon, I have been an evangelist to hundreds of thousands of paid subscribers, and many more investors beyond. My message has been consistent and clear, and I don’t regret focusing on dividends a bit. Here’s how it all started.

Back to Monterey and Woodstock

I’ve been developing investment strategies for investors like you before The Association kicked off the 1967 Monterey International Pop Festival with “Along Comes Mary” or Richie Havens opened Woodstock in August 1969. I started soon after John F. Kennedy was shot in Dallas in November 1963, and even before Dr. Martin Luther King, Jr. was shot at the Lorraine Motel in Memphis in April 1968. That’s a long time ago. The ‘60s was of course a seminal decade in American history. Key events, including the difficult investment environment of the ‘60s, seem like yesterday.

My 1964 Beginning

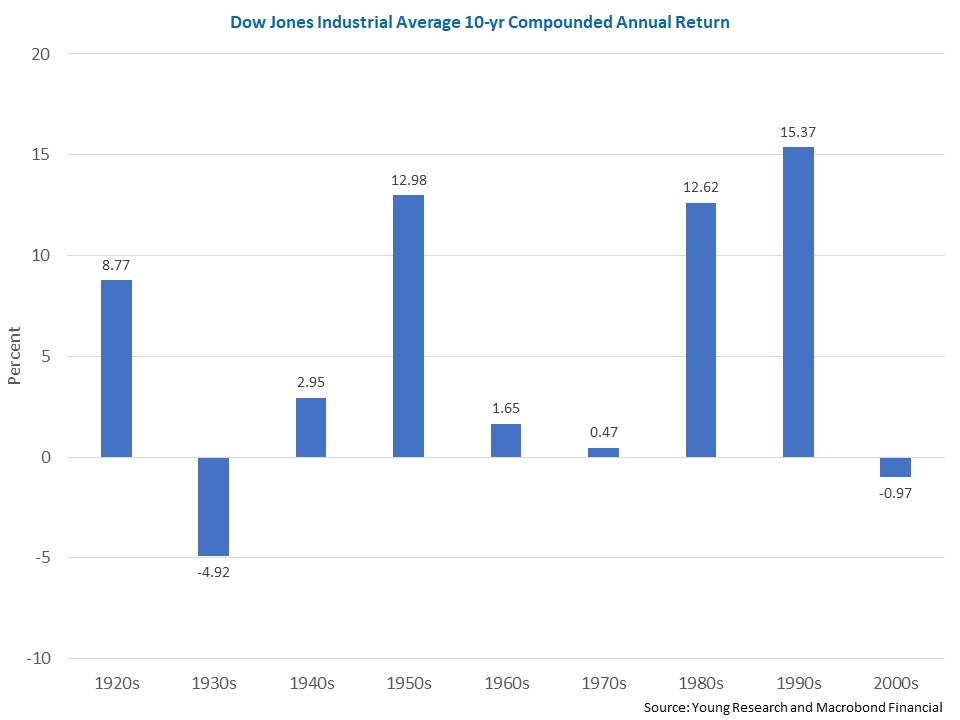

I’ve put together a display that tracks the Dow Jones Industrial Average through the decades. When I entered the securities business in the summer of 1964 (with Ed Rosenberg, Clayton Securities), I had no way of knowing that during my complete career in the Boston investment community, which ended in 1981, the Dow would end lower than when I began. How would you have liked to have retired in 1964 and faced a 16-year Dow downer? Talk about retirement financial hell.

As my display indicates, the decade of the ‘60s provided a sad annual average return (ex-dividends) of only 1.65%. Moreover, the 1970s were set to be even worse. When the curtain came down on this miserable decade, investors had scored an average return of only 0.5% (before dividends). Thankfully for conservative investors today, as has been the case well before the ‘60s and ‘70s, dividends remain the name of the game.

Ben Graham’s Powerful Investment Advice

With my first reading of Security Analysis by Ben Graham in 1963, I climbed on the dividend bandwagon. Today, it’s still my most powerful investment influence. Ben was Mr. Dividends. I became attached to the concept before I landed at Clayton Securities at 147 Milk St. in Boston’s financial district. As early as 1964, I knew I would concentrate on dividends throughout my investment career.

Unwavering Advice

Well, writing to you now, five decades later, from our outside kitchen/living space in the heart of Old Town, Key West, I can’t help but think how much water has gone under the bridge through the many decades. But if you have been with me over the years, you are keenly aware that it is indeed the combination of dividends, compound interest, perspective and patience that frames the message I deliver to you month after month. I do not change course. You can count on it.

Concentrate on Dividends

Go back to my display and note how kind the ‘80s and ‘90s, unlike the ‘60s and ‘70s, were to investors. So far, this decade (ending in 2019) is on a solid path. The problem is, no one really knows in advance what course the Dow will take in any given decade ahead. What investors do know with reasonable assuredness and peace of mind is that the prospects for dividends and dividend increases for stable, well-managed companies are good. (I pay scant attention to NASDAQ companies.) I concentrate on dividends for you and for me each month. We are in the same boat here. What is good for me is good for you and your family.

Whether or not you are on the dividend bandwagon yet, but you want to learn more about how a portfolio focused on compound interest can help you and your family save for retirement, fill out the form below.

You will be contacted by a seasoned member of the investment team at Richard C. Young & Co., Ltd., my family-run investment counsel firm. They’ll offer you a free portfolio review (no-obligation whatsoever). You’ll get a full picture of whether a portfolio focused on dividends and compounding can work for you.