That’s a question I put to readers back in 1988, and which is now relevant to today’s economy. The Federal Reserve is rapidly raising rates, and that is good news for savers who want to invest in bonds with decent interest rates, but the implications for the greater economy are also noteworthy. Here’s what I wrote in response to that question then:

Do Governments Cause Recessions On Purpose?

A recession is a prospect in the second half of 1989 because smart presidents realize that it’s tough to get re-elected if the public is dealt a recession before a presidential election year. It’s wise to take the recession medicine in the first year of a new term. I can’t overemphasize this point. Ike and Jimmy Carter fouled up and dropped a recession on voters’ plates in the final year of a presidential term. The result: neither’s respective party was re-elected. Over and over again, recessions begin in the first year of a four-year presidential term. I see no reason why things should be different this time around.

“Wait a minute,” you ask. “Are you saying, Young, that governments cause recession on purpose?” Oh, yes! And here is adequate evidence to support this view.

For openers, the gentlemen who control the money switches at the Fed can throw the economy on a recession course by slowing the money supply growth and raising short-term interest rates. And if you have missed it, that is precisely what has been going on over the past year.

M2 growth has been cut from 7% to 1%. High powered money (currency and bank reserves) growth has been cut sharply, and for good medicine, interest rates have been forced up literally from the day 1988 got under way. Your most important benchmark rates, the rates on 90-day CDs and 90-day T-bills, have soared in 1988 even though you were told by an unfortunately large number of advisors and brokers that just the reverse would occur in 1988. The 90-day CD rate has gone through the roof, climbing to 8.5% from 6.6% last February. You can now get 8% on risk-free 90-day T-bills versus only 5.6% last February. Some rate decline, wasn’t it!

So is Joe Biden attempting to avoid the mistake made by Carter, to whom he is so often compared? It’s too late to take a recession in his first year, but it’s better now than later.

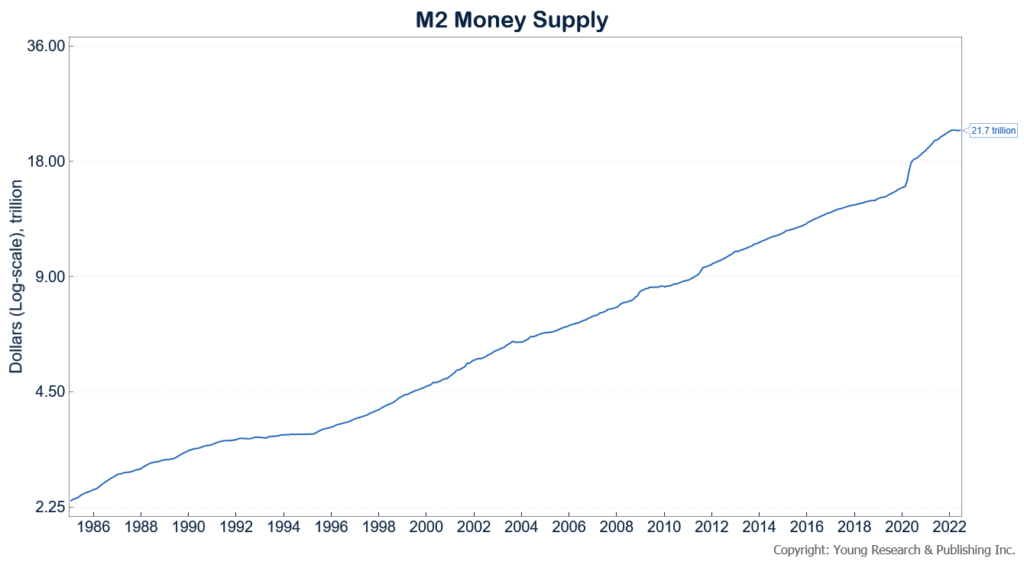

Of Biden’s intentions, your guess is as good as mine. What shouldn’t be in doubt is the ability of the Federal Reserve to drive the economy into recession. As I wrote, “the Fed can throw the economy on a recession course by slowing the money supply growth and raising short-term interest rates.” Take a look at my chart of M2 going back to 1985 below:

You can see that not only has M2 growth slowed, but it has also begun to decline. This is a significant event for the economy.

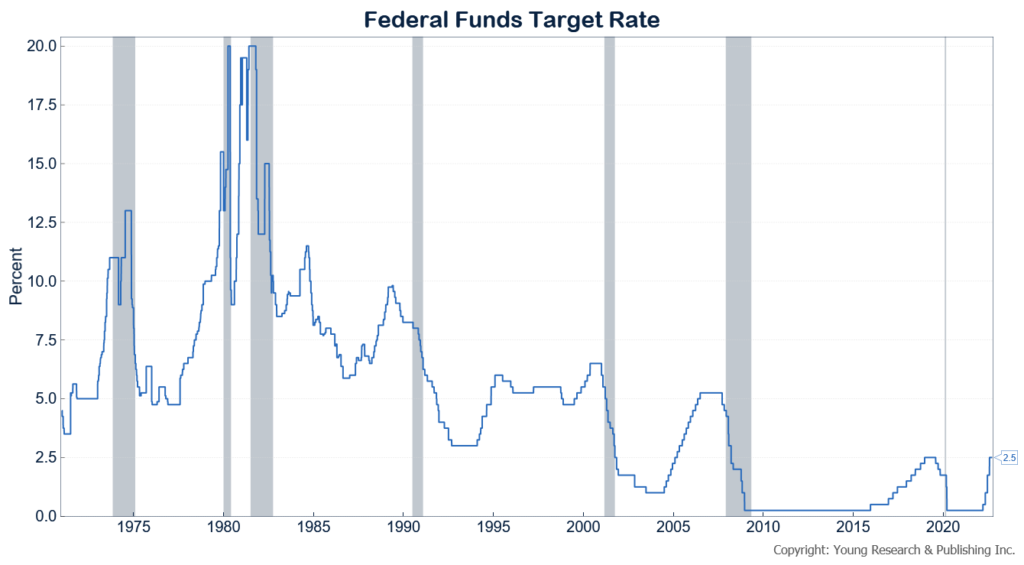

Now take a look at the Fed Funds Target Rate with recessions shaded over in grey (below). As you can see, a recession occurred shortly after nearly every significant increase in the Fed Funds rate.

The Fed has both slowed the growth of the money supply and raised short-term interest rates. Fed Chairman Jerome Powell may say there’s no recession and that the Advance GDP estimate should be “taken with a grain of salt,” but only history can sit in judgment of those statements.