Model Guidance: No Changes for the Week

My short-term Bull & Bear Portfolio consists of 9 equally-weighted long positions and 3 equally-weighted short positions. Both the long and short stocks are selected from the Dow Jones Industrial Average. If the Dow advances over the period in which my 12-Dow stock portfolio is open, the model will make money with the stocks that advance and will lose money with the stocks that decline. And the opposite will prevail for the short stocks. Each week, I will review the model portfolio for potential changes. If no changes are required, I’ll simply post no changes for the week. You can read more about my Bull & Bear Portfolio here.

Featured Company: Home Depot (NYSE:HD)

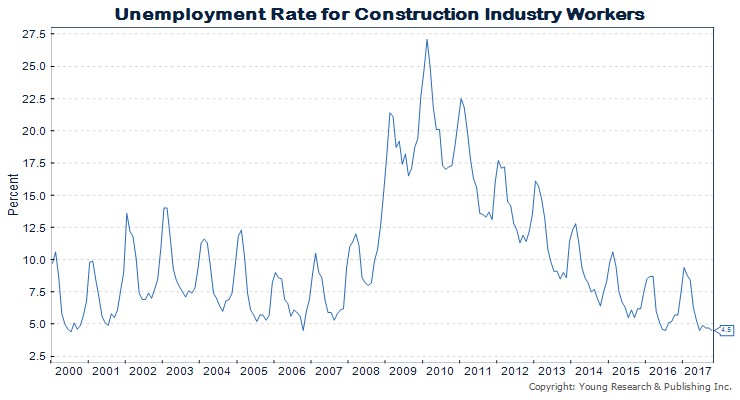

After Hurricanes Harvey and Irma pounded Texas and Florida with devastating wind and rain, there has been a frenzy of construction to rebuild and replace all that was lost. Estimates are that $200 billion worth of damage was done. Crews are busy all around Key West where Debbie and I live, and in and around Naples where my family run investment advisory firm, Richard C. Young & Co., Ltd. has its office. In Houston, residents are hoping to recover from Harvey, which affected as much as 14.2 percent of the city’s housing. If there can be a silver lining, it is that unemployment among construction workers, many of them out of work or underemployed since the financial crisis began, is at record lows.

In October, unemployment for construction workers matched its lowest recorded level for that month, 4.5%. Over 6.93 million Americans were employed in construction jobs, the highest of any time outside the height of the building boom from May 2004 to November 2008.

The recovery in the construction industry really took off in late 2011 when housing starts finally broke out of the depressed range they had found themselves in after the bust. In November of 2011, starts broke through 700k a month and never looked back. In September 2017, there were 1.127 million starts.

Standing ready to supply the rebuilding effort are companies like Home Depot. Back in 1978, the same year I began writing the first iteration of Young’s World Money Forecast, Bernie Marcus and Arthur Blank were sitting in a coffee shop in Los Angeles laying out their plans for a superstore that would not only sell customers tools and hardware, but even teach the customers how to use them.

By 1979, with help from investors, their vision—The Home Depot—was born in Atlanta, Georgia. The first store was a 60,000 square foot warehouse with more items for sale than any other hardware store. The model was a hit. Today The Home Depot is the world’s largest home improvement retailer. Stores are now usually around 105,000 square feet in size, and there are more than 2,200 locations across North America.

I added Home Depot as a long position in my initial Short-Term Bull & Bear Portfolio. The company has been paying a dividend since 1987. Home Depot has never cut its dividend, but it did leave the payout flat for two years during the depths of the housing market bust. Since then, HD has been quickly raising its dividend each year, with a 29% boost in 2017.