You Want the Limo, Not the Public Bus

Your investing future does not have to be relegated to a public transportation type of experience. You have a choice. And you can go in first class comfort or, instead, take a seat in the back of the bus. Here’s what I mean.

To start, don’t spring for yesterday’s investments – stock index funds or most equities centric funds. Don’t settle for government bonds that pay virtually nothing today, or for casino-like big S&P 500 stocks that pay no dividends but often sell for criminal market cap-to-sales ratios.

By now you undoubtedly realize that robo-advisors, whatever they are, offer zero value. “Advisors” manning the phone desks at massive fund groups are often kids about your grandkids’ ages. And you sure don’t want the investment products larded with sales charges from planners and wirehouses. That’s sure no way to travel.

At our family owned investment counsel firm, we offer a blue-chip option where you can find comfort amongst kindred spirits. We have decades of experience in personally consulting with conservative families and small business owners planning for a secure retirement or perhaps already in retirement.

Our family owned counsel business, unlike industry behemoths, offers the maximum in flexibility in dealing with, for example, bonds. Being nimble is the last thing you’d say about enormous mutual funds. Our company’s size and expertise allow us to capture opportunities in a wide range of fixed-income markets – municipals, treasuries, corporates, high-yield, loans, mortgage-backed securities, and, should the opportunity arise, even foreign currency denominated bonds.

Investing in a bond mutual fund today is akin to commuting to work on the bus.

The Good and Bad News

The good news:

- Someone else drives.

The bad news:

- The bus won’t be leaving when you want to leave.

- The bus is on its inflexible schedule, not on yours.

- The bus won’t pick you up at your doorstep or avoid traffic jams.

- The bus won’t be swinging by the pharmacy after work so you can pick up your prescription.

The bus rules. Bus rules are for the benefit of all riders. Period.

Mutual funds offer a similar experience. For example, fund managers are often restricted in what they can buy. This means, when you invest in a fund with a medium-term maturities mandate, you will get exactly that – medium-term maturities. It doesn’t matter if short-term corporates are more attractive, if high-yield bonds are offering the opportunity of a lifetime, or if there is simply too much risk in medium-term corporates for a given level of return. You signed up for medium term maturities corporates and that’s what you’re going to get.

The burden of specific decision making is on your shoulders.

At RCY, Ltd., we are not burdened by fund constraints. Let me give you an example. Early this year almost half the assets of our bond portfolios were in Treasurys. In February and March, as the economy ground to a halt and yields on corporate bonds soared, we shifted gears moving en masse out of lower yielding Treasurys and into much higher yielding corporates. Our clients think of us as the black car limo service of bond investing, rather than one-for-all public transportation.

In April I made my initial individual bond purchase under my new buying program. I bought the new issue Weyerhaeuser bonds. Weyerhaeuser, a large forest products company, owns 12-million acres of Timberland, making it one of the largest private landowners in America. Weyerhaeuser bought my old favorite Plum Creek, which you probably remember from my strategy reports.

The Weyerhaeuser bonds I purchased have a 4% coupon and mature in 10 years. The individual investor is a babe lost in the wilderness when it comes to hunting down individual bonds for a bond portfolio.

How about new issues? Forget it. I have been involved in this market since 1971, and I can assure you that individuals have no place even considering entering that fray.

As of the end of March, Weyerhaeuser had $5 billion in net debt (debt after deducting cash). If you divide the $5 billion debt by the firm’s 12 million acres of timberland, there is $400 in debt held against each acre of Timberland. Assuming no other assets or liabilities, as long as Weyerhaeuser’s land is worth more than $400 per acre, bondholders likely would be made whole in the event of default. This, of course, is a back-of-the-envelope calculation, but we like the margin of safety the company’s land provides.

I have always remained fully invested in a counter-balanced, widely diversified portfolio. I don’t jump in and out of the market. The word I emphasize here is balance. Here’s why, along with my firsthand experience of what happens when counterbalancing (balance plus) is not in force.

Back in the old days, most Harley engines were bolted directly to the frame. Talk about vibration and calamity. With constant vibration, nuts and bolts tend to loosen and fall off on an all too regular basis. On long-distance road trips, breakdowns in, say, the Canadian Rockies, are cause for concern. Today’s Harleys feature counterbalanced engines offering both a smooth ride and a minimum of road-trip calamities.

To enjoy a smooth ride in the financial markets without the constant threat of financial calamity/vibration, I have long-advised Wellesley (65/35 bond) and Wellington (65/35 stocks) funds. Sadly, both have exploded in size. turning into far less attractive options for new money.

Not a Single Double-Digit Down Year

Since bond-heavy Wellesley first opened in 1971, it has not suffered one double-digit down year. Not a single one.

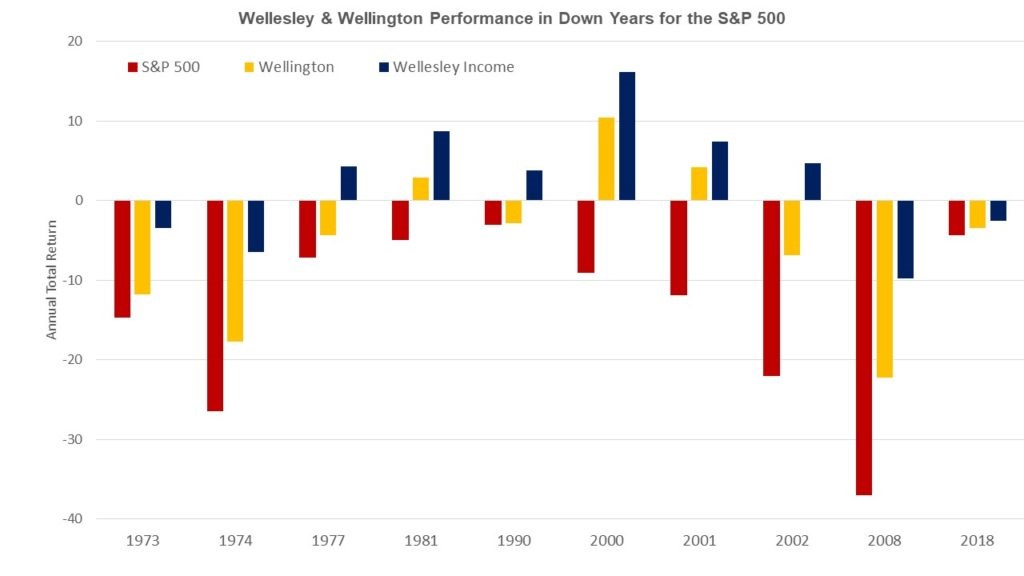

The chart below shows the return of the balanced Wellesley (as well as Wellington) in each down-market year since 1970 (Wellesley’s inception year).

During this same period, the S&P 500 stock index experienced 10 down years

(As a side note: I no longer advise most index funds, and certainly not funds indexed to the S&P 500.)

Wellesley declined in only four of those years. And with the exception of 2018, balanced Wellesley’s declines were only a quarter of the decline in the S&P 500 stock index.

Since the balanced Wellesley’s first full year in operation, the 65/35 (bonds/stocks) fund declined in only seven years. That’s a .857 batting average. The best hitters in major league baseball rarely hit .400.

With the exception of 1973, in each year following a Wellesley annual decline, balanced Wellesley has been up double digits.

Here is a scary Wellington liquidity fact. In order to maintain a passive stake in a purchased stock of no more than 3% of the outstanding shares, Wellington today is confined to stocks with a market value of at least $73 billion. That’s a minuscule field. Formerly suitable funds have today become too big for their own good.

Today, in 2020, there are just 80 U.S. companies with a market value of $73 billion or more. This mini group compares to the more than 5,000 U.S. companies with a market value over $100 million.

I am retired from the newsletter writing business. As chairman of our 100% family-owned Investment counseling firm, Richard C. Young & Co, Ltd., I now work full time (yup) on global investment strategies. Ltd. has been in business for over three decades and our company works personally with families and small businesses across America.

Today I concentrate on individual stocks and bonds as building blocks for my own portfolio, as well as for clients. During the coronavirus disruptions, I am fast on the trail of investing in exactly the type of big blue chips I have advised through the decades for my strategy report subscribers. Looking to the future, these individual blue chips will be the focus of my own personal investing, as well as that of our company.

I’d like you to join me and my family. Balance, patience, and compounding (BPC) offer so much.

Investment counseling is as deeply personal as it is private. And solid relationships, as you probably know from your life’s endeavors, count for much. Why not let us take the load of day to day investing decision making off your shoulders.

Richard C. Young & Co, Ltd. is but a phone call away. Call (888) 456-5444 today while the matter is fresh on your mind. You’ll be glad you did.

Warm regards,

Dick Young