The Final Nail in the Coffin for Mutual Funds

The mutual fund industry has been facing headwinds for years. First, the industry became too big. So dominant were the biggest funds, they couldn’t invest without moving the market themselves.

The next problem for mutual funds was the advent of the ETF. ETFs hollowed out the high-fee actively managed equity fund industry.

I wrote about these problems here in November of 2006:

I write often that the majority of mutual funds offer no compelling reason for investment. Here’s a double shocker for you. Of the top-ten largest equity mutual funds, seven come from one family. How could one management company capture so many places in the top-ten-size race? Must have pretty spectacular performance, right? That must be the reason. Well, performance has been fine, but the single compelling reason these funds sit at the top ten in size is that all seven have 5.75% front-end sales loads. Sales pressure gets big results. The majority of fund sales for load funds are made by salesmen to unsophisticated investors. No knowledgeable investor would invest in a load fund.

The second big surprise is that I now think ETFs have come closer to being in a position to overwhelm the mutual fund industry. For the ETF industry as a whole, it is a little early in the game because, as yet, not all the chairs at the table have been filled. The fixed-income side needs to broaden out a lot. I especially hope that Vanguard will substantially broaden its ETF menu. I would guess that within a year I will be able to give the green flag to the ETF industry as the lead horse in the long-term race between ETFs and the mutual fund industry. There will be a select group of mutual fund groups that will continue to prosper as the ETF industry hollows out the mutual fund industry.

Holding back ETFs’ complete domination of the fund industry has been an SEC rule that forced companies offering ETFs to apply for “exemptive orders.” Because ETFs weren’t technically allowed to exist, companies intending to operate ETFs had to be granted an exception.

Today, with more than 2,200 ETFs in the marketplace, the SEC has finally voted to adopt a new rule to modernize their regulation. The commission announced:

The Securities and Exchange Commission today announced that is has voted to adopt a new rule and form amendments that are designed to modernize the regulation of exchange-traded funds (ETFs), by establishing a clear and consistent framework for the vast majority of ETFs operating today. The adoption will facilitate greater competition and innovation in the ETF marketplace, leading to more choice for investors. It also will allow ETFs to come to market more quickly without the time or expense of applying for individual exemptive relief. In addition, the Commission voted to issue an exemptive order that further harmonizes related relief for broker-dealers.

“Since ETFs were first developed over 27 years ago, they have provided investors with a number of benefits, including access to a wide array of investment strategies, in many cases at a low cost,” said SEC Chairman Jay Clayton. “As the ETF industry continues to grow in size and importance, particularly to Main Street investors, it is important to have a consistent, transparent, and efficient regulatory framework that eliminates regulatory hurdles while maintaining appropriate investor protections.”

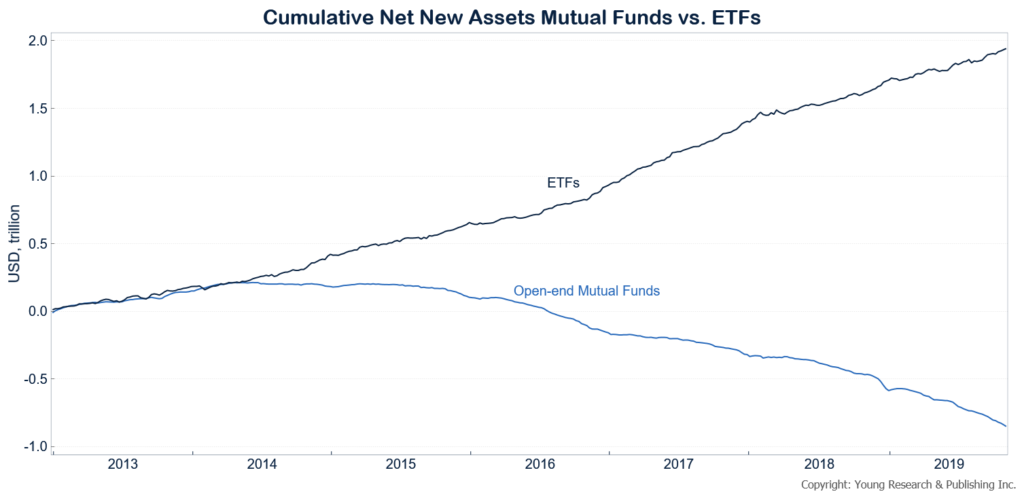

The modernization of the ETF industry is probably the final nail in the coffin of mutual funds. You can see in the chart below the magnitude of investors’ move from mutual funds to ETFs. But ETFs aren’t much better today. The ETF industry has grown so large; it is facing some of the same issues I noted about the mutual fund industry in 2006. Today, investors are better served by developing a portfolio of dividend-paying stocks, rather than investing in the index ETFs that have become so popular.

If you need assistance in building a portfolio of dividend-paying stocks, fill out the form below. A seasoned member of the investment team at my family run investment counsel firm will contact you to explain our individual stock investing strategy and how you might benefit from it.