Rising Dividends: Decades of Focus on a Winning Strategy

In 1987, I sat down with Bill Lippman for a conversation about L.F. Rothschild Fund Management’s “Rising Dividends Fund.” Bill had been the founder and president of the Pilgrim Group mutual funds for 25 years before he sold the firm. Bill then moved over to the New York based, L.F. Rothschild Fund Management, at the time a new subsidiary of L.F. Rothschild investment bank. (The Rising Dividends Fund would later become the Franklin Rising Dividends Fund, which still trades today, though this is not a recommendation to buy).

The Rising Dividends Fund focused on what I have been recommending to my readers for years; solid companies with strong records of increasing dividend payouts. I have been focused on dividend payments since my days at Babson reading Ben Graham and David Dodd.

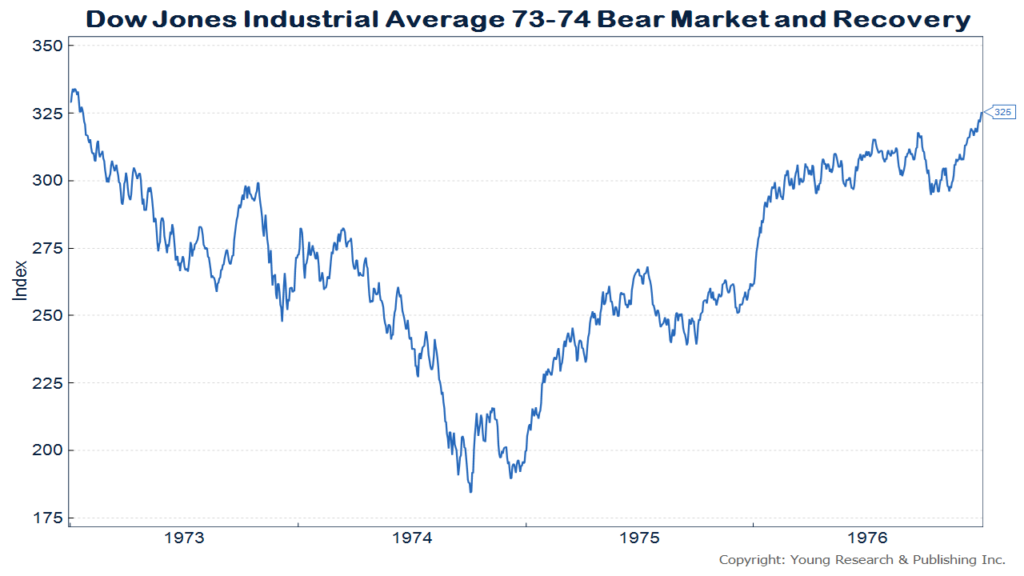

Bill was interested in rising dividends as a way to protect his fund’s owners from experiencing the type of punishment in their portfolios they felt in the bear market of 1973-1974. Those unhappy days of “stagflation” saw unemployment of 8.5%, CPI increases of up to 11%, and a drop in the Dow Jones Industrial Average of 46%. Afterward, investors were not eager to have their savings ripped apart again. The pain was so bad that even in 1987 when Bill and I discussed his Rising Dividends Fund, the lessons of 73-74 were still remembered well.

When we talked, Bill said “In 1973-1974, we had a really bad market. It was a disaster…and it went on and on for a couple of years. It seemed like it would never end. One then asks, ‘Is there a better way?’ As it turns out, yes, there is a better way. You must have a philosophy, and you must stick to it. Don’t be the victim of the latest hot story that comes off the tape. And that’s what we did that was different. We evolved a philosophy that made sense. We selected companies that increased dividends and had low debt and low P/Es. We wanted a solid game plan that we could follow with comfort through good markets and bad.”

My focus for you today, just as it was in 1987, is on quality dividends from companies that are dedicated to increasing their payouts. As part of the RCs program at Richard C. Young & Co., Ltd., and in my recent coverage of the Dow stocks here on Youngsworldmoneyforecast.com, I consistently focus on finding companies that do just that.

Another thing Bill said in our discussion that really resonated with me was a piece of advice he gave to all investors “Put down in writing what you really believe in, and then stick to it.” I encourage you to do that right now. Don’t wait until later, or let inertia allow you to forget. Do it right now. Write down what you want to accomplish by investing, and how you plan to do it. Then stick to it.