The Must-Know Investment Concept

The concept of an efficient frontier is central to proper portfolio management, but far too few investors are familiar with its use and application. Brokers and advisors, more interested in pushing product than offering investment counsel, may be to blame. An Efficient Frontier can help you calibrate risk and find the portfolio you are likely to be most comfortable with. Here’s what I wrote about the Efficient Frontier back in 2002:

The concept of an Efficient Frontier is central to everything we do at our companies. First, we lay out our basic investor tenet of diversification and patience built on a framework of value and compound interest. Next, we overlay any investment plan under review with an eye on an Efficient Frontier. I write about this pivotal concept for you in every letter. You will read little or nothing about an Efficient Frontier in other strategy letters. I have no idea why because the concept is so absolutely central to proper portfolio construction. An investor not up to speed on both the mathematics of compound interest and the power of an Efficient Frontier is operating far beyond the fringes of investment reality. In fact, I would go as far as to say that an investor devoid of a thorough working knowledge of these two powerful investment concepts has little chance of achieving a comfortable, rewarding retirement. Hence my inclination to hammer away monthly at both concepts.

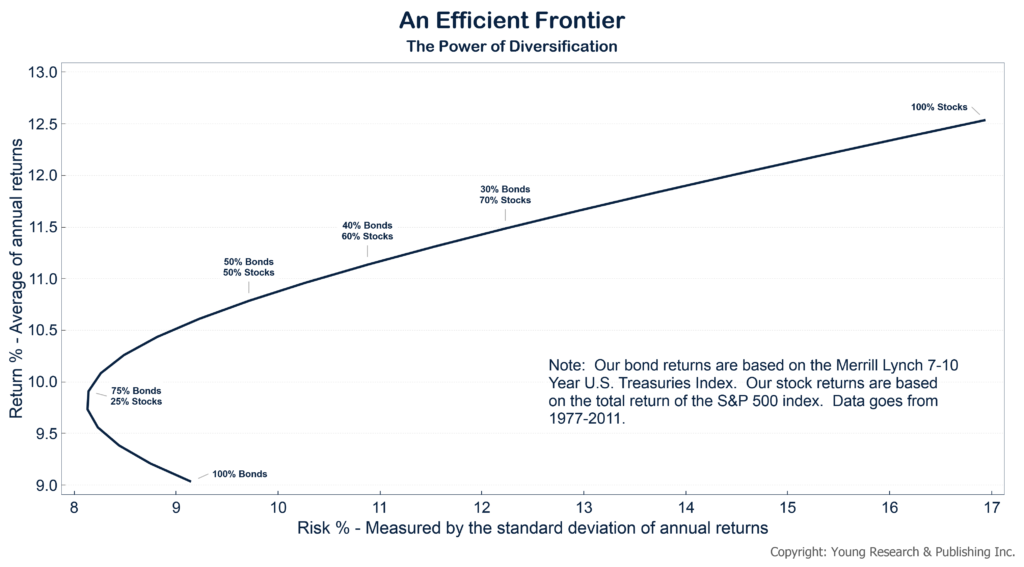

As I have written often, an Efficient Frontier is nothing more than the line that connects one optimal portfolio across all levels of risk. An optimal portfolio is the mix of assets that maximizes portfolio returns at a given risk level. My chart illustrates an Efficient Frontier for a combination of two asset classes—long-term corporate bonds and stocks. We have used data from a representative long-term corporate bond fund and a suitable Index 500 fund.

Clearly an Efficient Frontier is about diversification. And investors saving in retirement portfolios or who are already retired want the appropriate mix of bonds and stocks. Here I’m writing to investors 50 years and older, but I’m tempted to mandate that investors in their 40s maintain a solid fixed-income component. I’ll suggest it, if not mandate it.

Exactly what are we looking at? It’s what I refer to as the boomerang. The vertical axis measures return; the horizontal axis measures risk. I always advise you to first gauge risk and much later worry about return. You’ll note, as you travel along an Efficient Frontier from left to right, risk gets greater. How much do you value a good night’s sleep? As I have reminded you often, between 1965 and 1981, a period of 16 years, the Dow fell 10%. Will such an extended period of stock market decline occur in coming years? I don’t know about 16 years, but I can count three. And the stock market is now down for the third consecutive year for the first time since 1950, so you tell me.

Personally, I invest with no view on where the stock market will be next year or the following, for that matter. I invest with the absolute knowledge that, long-term our population increases and that the stock market tends to generate a compound rate of growth that matches the compound rate of growth of GDP. We’re talking about 7% plus, of course, dividends. That’s my basis for investing in stocks—nothing more, nothing less. It’s not prudent to count on making one cent more long-term than the annual compound average GDP growth, plus dividends. If you are banking on more for yourself, you’re barking up the wrong tree.

If you are having trouble managing your portfolio’s risk, look for help at a seasoned, well regarded investment advisory like my family run firm, Richard C. Young & Co., Ltd. Talking with a professional can help you develop a retirement plan that will allow you to avoid crippling losses and achieve your goals. Read more about the concept of an Efficient Frontier by visiting Youngresearch.com here: