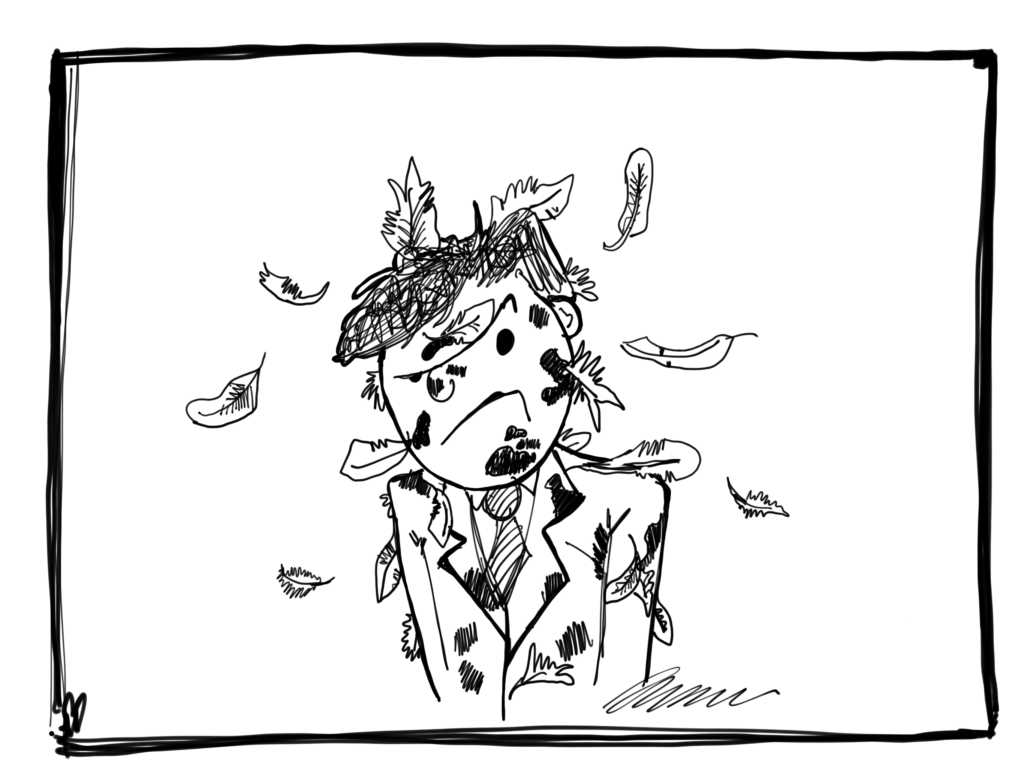

Investors Tarred and Feathered

The beginning of a long-term trend away from high-management-fee hedge funds, mutual funds and packaged product hawkers is picking up steam. For decades, individual investors have taken the bait from the high fee speculators and misallocators. Investors now appear to have awakened to the many-decade fleecing. Here, Market Watch highlights a fistful of troubling reminders of the ever-growing carnage.

- Last year, hedge funds shut down at a pace last seen in 2008.

- For the full year, a total of 1,057 funds were closed, topping the 1,023 liquidations seen in 2009.

- Hedge fund liquidations in 2016 surpassed the post-financial crisis peak.

- Average hedge-fund management fees fell to 1.48% in the fourth quarter from 1.49% in the previous three months.

- The average incentive fee for new funds declined to 17.71% from 17.75% in 2015.

- In 2016, the asset-weighted hedge-fund index returned 2.86%.

- The S&P 500, with dividends, gained 11.93%.

Benefactors of this bloodletting will be modest-sized, old-line, traditional investment council firms. These tight-knit client friendly and fee friendly firms harken back to a more civil time, when the best interests of a client topped the list of concerns in long-time family relationships. Preservation of capital and modest and consistent total returns were the order of the day. A steady flow of cash in the form of dividends and interest allowed relaxed clients to sleep well at night knowing that at all times their family advisor’s interests were meticulously aligned with their own. That’s just the way things were expected to be.

Today? Well you observe the results above.