“Inflation Dodger”

You want a history lesson? In 1987, I was interviewed by The Kiplinger Magazine – Changing Times (which is known today as Kiplinger’s Personal Finance). This wasn’t long after I had written Financial Armadillo Strategy with the late David Franke.

At the time, America was coming off some of its heaviest inflation ever, and investors wanted a solution to the problem. Despite those high rates of inflation in the 80s, I warned that even somewhat more moderate rates of inflation—like those Americans have seen over the last two years—do real harm to investors. “I don’t mean 10% or 15% inflation; 4% or 5% is absolutely debilitating,” I said.

Even then—like today—I was focused on dividends and compounding to fight inflation. From Kiplinger’s:

Those nearing retirement want assets that are safe but lucrative—easier said than done. Young’s “financial armadillo” seeks to deliver on both counts. It’s designed to place a protective shell around your portfolio, while allowing it to forage for profits at will. This armadillo has but three legs: equities for total return, Treasuries and gold. “The average investor has no conception of what total return is all about,” says Young. “From 1936 to 1986, the compounded growth rate for the Dow was 4.8%. If you take shorter time spans, the results are similar. That’s much less than you would expect.” But when you add dividends, the total return is 9.4%, says Young. “Dividends are extremely important. They should be worth about half the game.”

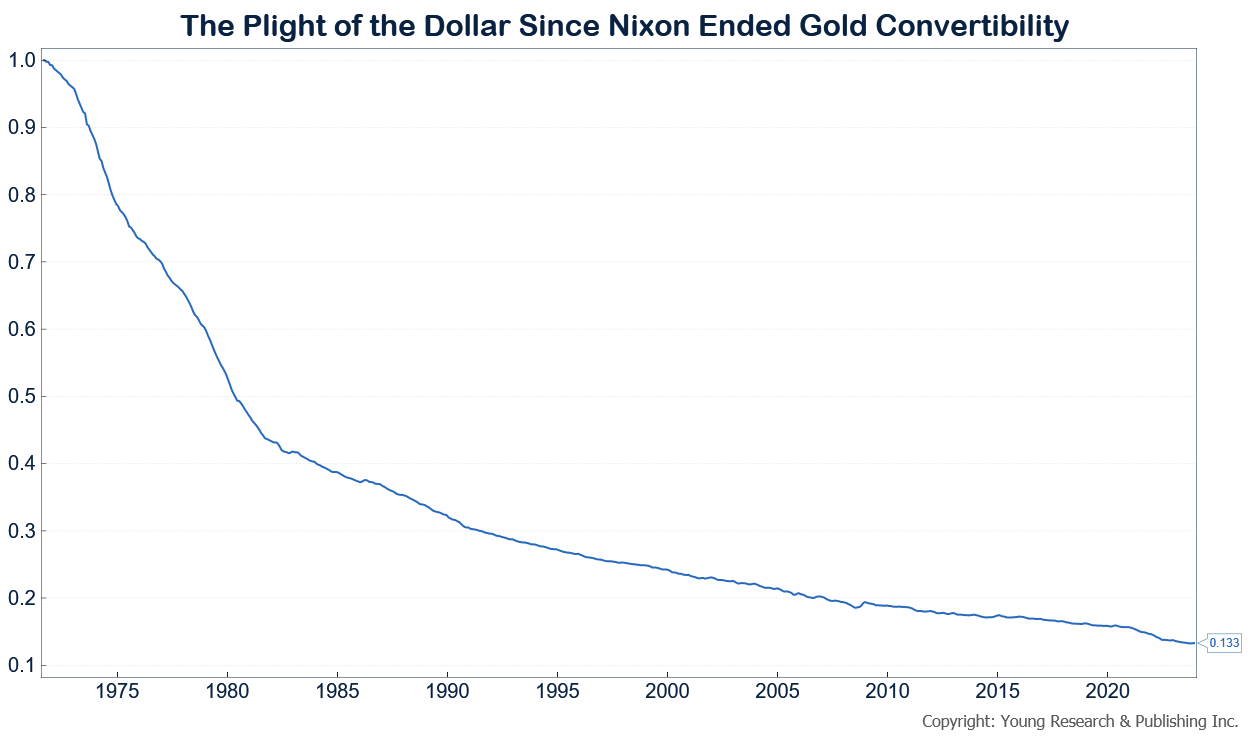

Take a look at my chart below on the plight of the dollar since Nixon ended gold convertibility in 1971. Compared to the dollar then, today’s dollar is worth only 13.3 cents.

Americans have watched the dollar decline in value ever since the government severed the dollar’s last links to gold, a return to which I have always advocated. The author of the article dubbed me an “Inflation Dodger.” That’s a name I’ll proudly accept in light of the destruction of dollar value since the 1970s. When enduring that sort of purchasing power loss, all retirees may need to become inflation dodgers. To this day, dodging inflation guides much of my work at my family investment firm.