How You Should Invest Today: Part II

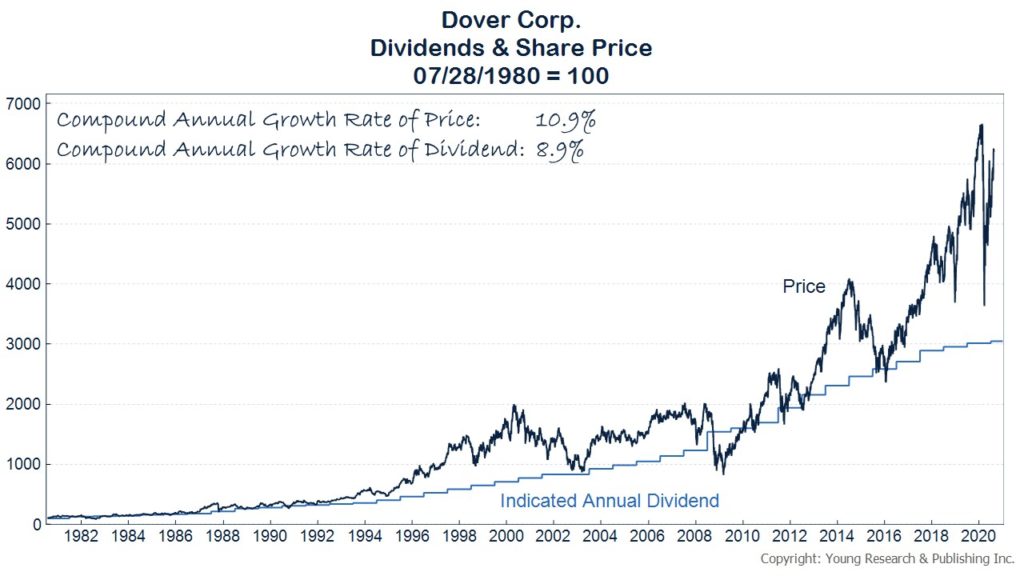

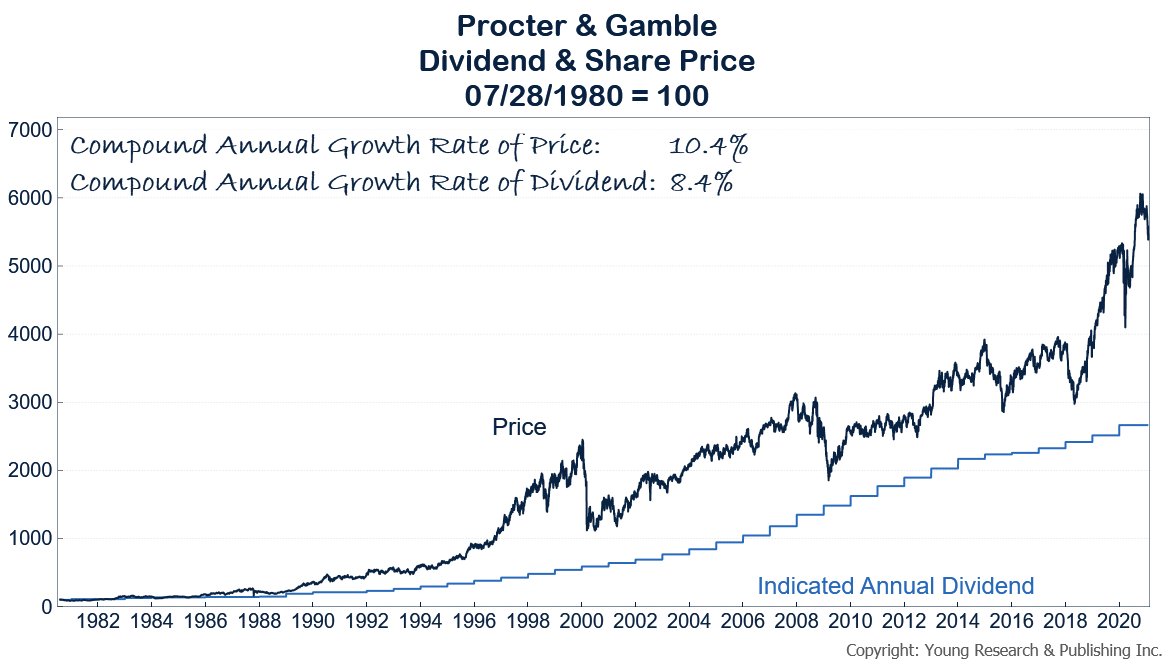

These two charts (below) on Dover Corp. and Procter & Gamble show you long-term compounded dividend and stock price growth for both.

In both cases, the long-term trend shows a pattern of consistent annual dividend growth matched with long-term stock price appreciation.

In Dover’s case, the dividend has compounded at an 8.9% rate of growth and the stock an even stronger and equally consistent 10.9%. For P&G the numbers have been 8.4% and 10.4%.

What you are looking at in both instances is decades of consistency, stability, and comfort for shareholders.

At our family investment counseling company, these are the only kind of companies we invest in for clients. Our master list of potential portfolio companies includes only companies with similar long-term records.

We never even consider companies without long-term records of dividend growth.

I have been writing about consistency, stability, and compound growth for five decades. And underpinning every report has been a foundation of dividends.

When you concentrate on dividend growth and stability, you never have to think about capital appreciation. It will take care of itself as my charts on P&G and Dover Corp. demonstrate, as long as the dividend is growing.

So, the easy lesson in this second part of my “how to invest today” series is to make dividends your password to investing both now and in future years.

Read Part I here.