Getting on the Map with Gold

I have been a longtime supporter of including gold in diversified portfolios. Gold is a safe-haven asset, an inflation and currency hedge, and a hedge against geopolitical turmoil and general market turbulence. It is an insurance policy of sorts. When everything else is down, gold is often up. Gold’s counterbalancing effects can dull the pain of a market rout.

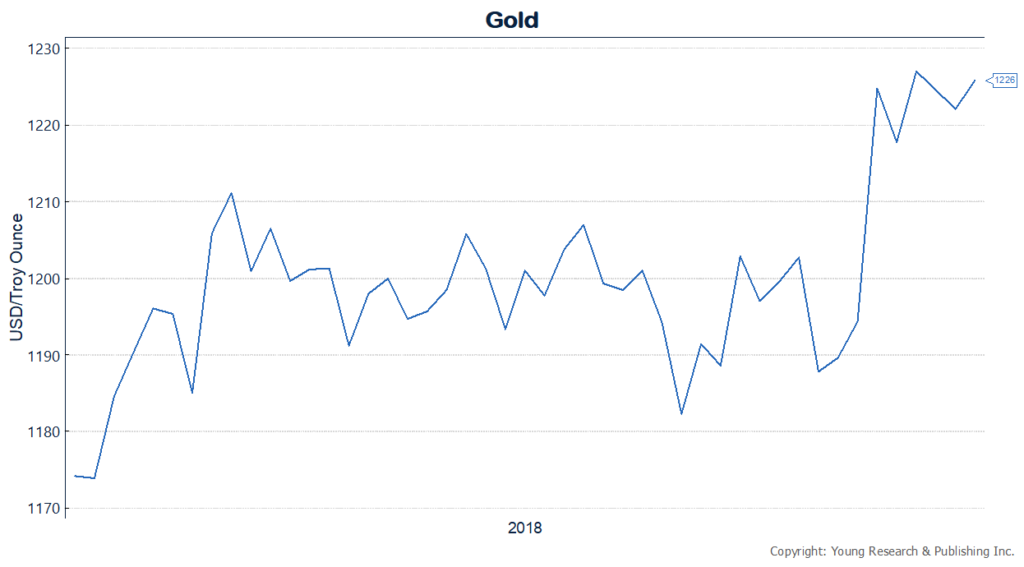

We have seen shades of gold’s counterbalancing power over recent weeks as both stocks and bonds have sold-off while gold prices have risen.

I’ve long been an outspoken advocate of owning gold (I say owning because I buy gold and do not intend to sell). I’ve spoken on gold at conferences around the country, and I have researched and written about gold for nearly 50 years.

Becoming a reliable purveyor of gold insight was no easy trick. At 30 years old I was given a tough, international assignment, and then judged by some of the most demanding names in the business. In August of 2017, I told readers the story of the research breakthrough that put me on the gold map. Here it is for you:

London, 1971

Portfolio strategy discussions and strategizing with the world’s biggest institutional clients started for me with a mix of Boston, New York, and London research. My institutional research and trading days trace back to August 1971 with Model Roland & Co. The Boston offices were on Federal St. in the old financial district. I was 30 years old.

Gold Research for Leo Model

By the summer of 1972, I was off to London on a gold/gold-shares research trip. This eye-opening experience gave me access and exposure to the largest players in the international gold market. I met contacts and gained background that would be invaluable to me, and thus to my clients, for the ensuing 45 years. Meetings at Samuel Montague and Consolidated Gold Fields, for example, allowed me to craft a detailed report for Leo Model on gold as a commodity as well as a monetary asset.

E.M.B. Comes Through

Mr. Model thought enough of my report to put it into the hands of no less than America’s dean of international monetary experts, Edward M. Bernstein. This was a little unnerving for me as a 30-year old who was prepared for a sour outcome and a lecture from Herr Model, a demanding employer.

Well, much to my surprise, Mr. Model soon received a note from E.M.B., perhaps the #1 expert in the world on the intricacies of gold: “I think the collection of papers on gold is excellent. It seems objective and pointed. I have no suggestions. … Put me on the list to get what Model Roland puts out on gold.”

That did it for me. I was on the map.