Dump All Low Yielding US Treasuries Now

Today we have a situation where the Fed has forced individual investors with life-time savings to subsidize corporate buybacks, acquisitions, and Wall Street banking industry borrowing and speculating. It’s what I call de facto robbing and stealing.

In reality, the Fed is nothing more than a private club to favor corporate and banking elites.

When the Federal Reserve was first established in 1913, Congress directed it to “furnish an elastic currency, to afford means of rediscounting commercial paper” and to establish a more effective supervision of banking in the U.S.

The Fed’s duties should have been left there. But no …

On 27 October 1978, President Jimmy Carter signed into law the Full Employment and Balanced Growth Act. The act requires the chairman of the Federal Reserve to connect the monetary policy with the president’s economic policy.

I would look to nullify the act in its entirety.

If the Fed is retained, its purpose should be confined to the narrow founding definition, and nothing more.

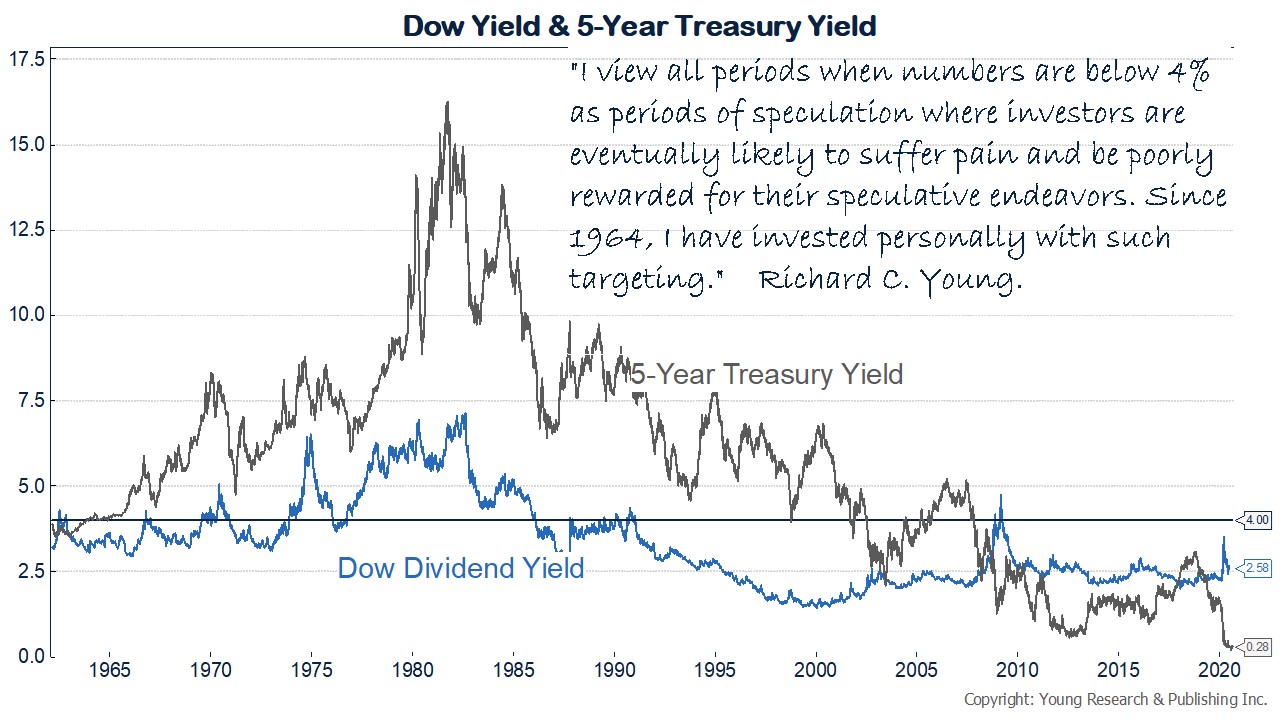

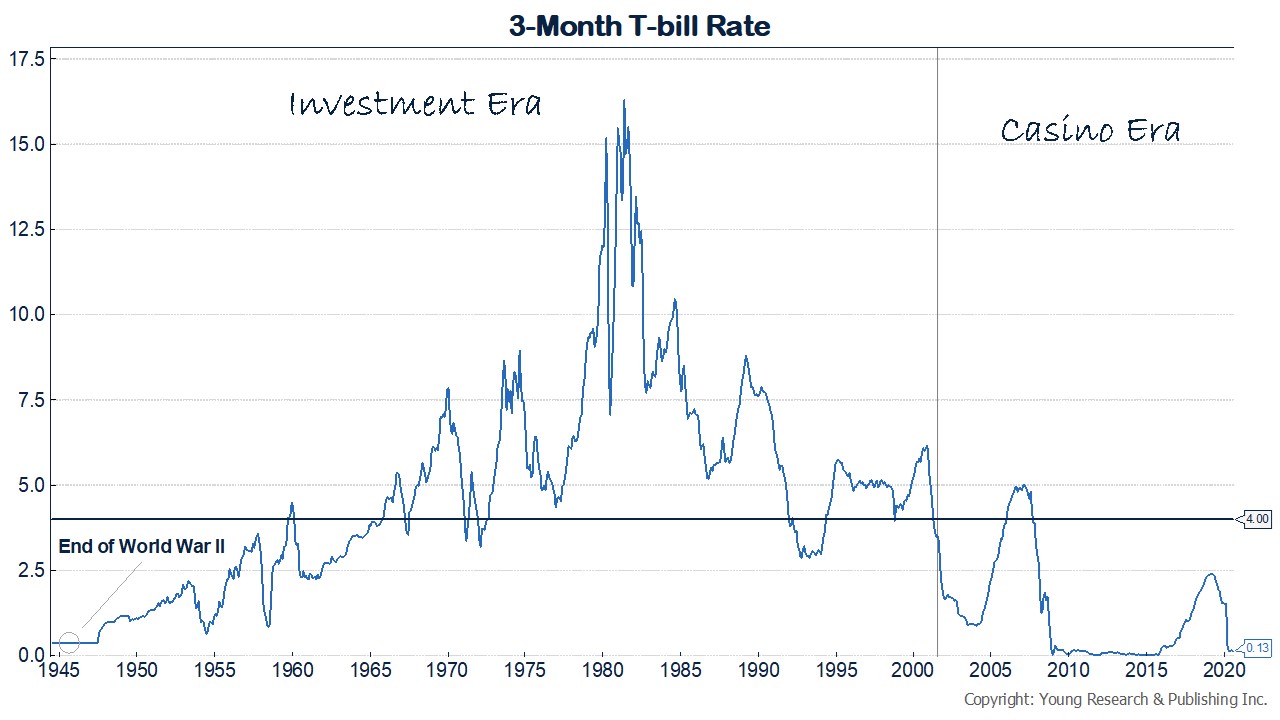

My two charts (below) indicate the circus climate the Fed has promoted today. Whenever interest rates stand below 4%, the economic and monetary system is out of whack.

Twice this century the Fed has allowed rates to sink below 4%. On the second of the two rebounds this century the Fed did not allow rates even to return to a more natural 4%.

Early this spring my family investment counsel firm sold all of our Treasurys. I also sold all of mine.

Today we are laser focusing on new issue corporate bonds, high-yielding blue-chip equities, Swiss franc denominated assets, and gold.

The Fed is attempting to control both the quantity and price of money. Bad things will happen and misguided individual investors will once again pick up the tab as the general stock market crashes in shock.