Can You Afford a 50% Loss?

Can You Afford a 50% Loss? That’s the question I asked readers in March 2014. I wrote:

Can You Afford a 50% Loss?

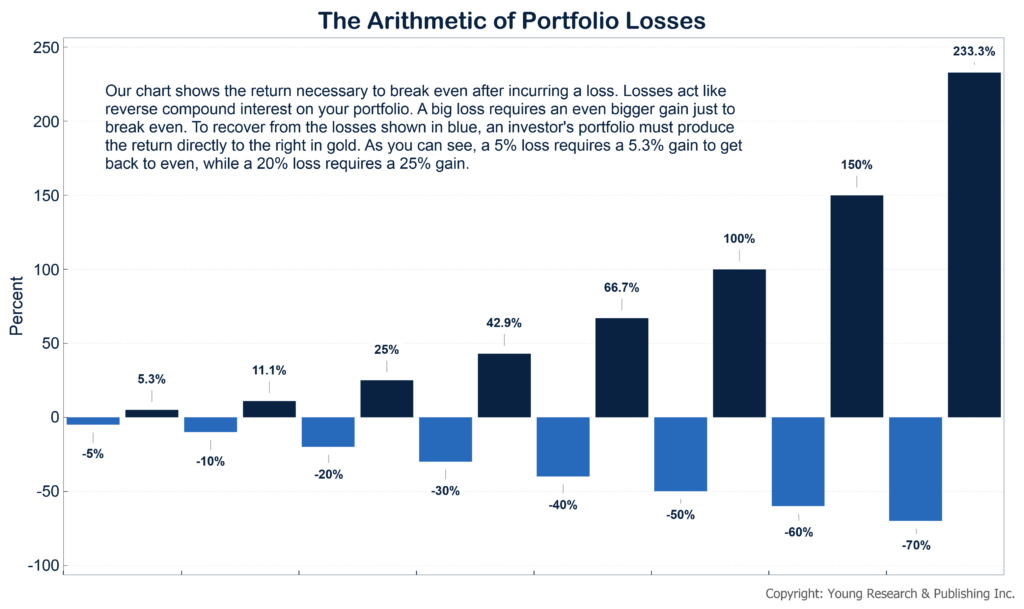

It’s impossible to have it all ways. In order to craft an investment portfolio that can act as an all-weather armadillo, you must be willing to forgo potentially substantial upside rewards to balance against the horror of a downside wipeout. If you are retired or saving for retirement in the not-too-distant future, you can easily get a knot in your stomach when you look at the basic math of downside portfolio protection. By example, when you lose 50% on an investment, you must make 100% the next trip to the plate just to get back even. And that’s without considering the negative drag of expenses and taxes on your gain, as well as the fact that you have not earned enough net-net to make my mandated 1% quarterly draw. I cannot impress upon you enough how ugly things can get—and fast. For a big percentage of investors, the mindset to take a deliberate and laser-focused armadillo-like approach is never achieved. For this unfortunate crowd, the ticking time bomb has already been set. What awaits is the explosion and ensuing financial carnage for the sad family.

The tragedy of big losses in an investment portfolio is felt most by those with the least time to recover. That includes retirees and those about to retire. You don’t have the luxury of a steady paycheck to rebuild savings, or the time to wait for markets to recover. Your livelihood in retirement is your portfolio. You can see the pickle investment losers find themselves in on my chart of the arithmetic of portfolio losses below. Each light blue loss has a corresponding dark blue gain that must be generated in order to simply get a portfolio back to even. If you’re entering retirement soon, or you’re already enjoying life after work, it’s no longer the time to take chances. Invest with prudence.