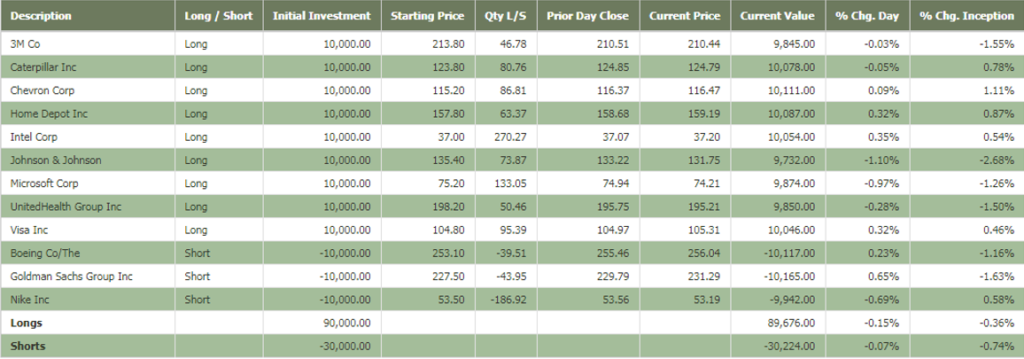

Bull and Bear Portfolio Update: 9.22.17

Model Guidance: No Changes for the Week

My short-term Bull & Bear Portfolio consists of 9 equally-weighted long positions and 3 equally-weighted short positions. Both the long and short stocks are selected from the Dow Jones Industrial Average. If the Dow advances over the period in which my 12-Dow stock portfolio is open, the model will make money with the stocks that advance and will lose money with the stocks that decline. And the opposite will prevail for the short stocks. Each week, I will review the model portfolio for potential changes. If no changes are required, I’ll simply post no changes for the week. You can read more about my Bull & Bear Portfolio here.

Featured Company: Visa Inc., (NYSE: V)

In 1958 Bank of America launched the first consumer credit card for middle-class Americans and small to medium-sized merchants. The business grew rapidly, going international in 1974 and adding a debit card in 1975. In 1976 the Bank Americard became Visa. In 1995 Visa co-created EMV which allowed interoperability between all chip-enabled cards and terminals. In 2001 Visa surpassed 1 billion cards issued. In 2007, a restructuring of Visa’s global network was begun, creating Visa Inc. In 2008 Visa went public on the New York Stock Exchange.

Today Visa operates the world’s largest consumer-payment system, with nearly 2.5 billion credit and other payment cards in circulation across more than 200 countries. Visa is the #1 player in the electronic payments industry, with a market share of nearly 60%. Visa connects and clears transactions between banks and merchants. The company’s vast network creates high barriers to entry and a durable competitive advantage.

Visa sports a dividend yield of only 0.66%, but the company is a dividend growth powerhouse. Over the last five years, Visa has compounded its dividend at a rate of almost 26%. Not surprisingly, the total return on Visa shares over the same period is also 26%.

Visa’s growth is closely tied to that of the global economy, but the company also benefits from the ongoing transition to electronic payments. Cash still accounts for 85% of the world’s transactions and 40% of transactions in the United States. The shift to electronic payments has a long way to go. That means more potential market share for Visa to gain as it expands its business further around the globe.